Best Features of Top Crypto Mastercard Prepaid Cards

You discover the best crypto mastercard prepaid cards by focusing on rewards, fees, security, and global access. Nexo Card, Coinbase Card, Gemini Credit Card, Crypto.com Card, and Binance Card lead the market. Compare supported cryptocurrencies and usability. Your spending habits and crypto mastercard prepaid needs shape your choice of crypto mastercard prepaid card.

Key Takeaways

Choose a crypto Mastercard prepaid card based on your spending habits and needs. Consider factors like rewards, fees, and supported cryptocurrencies to find the best fit.

Look for cards with no annual fees and strong cashback rewards. Cards like the Gemini Credit Card offer high rewards without requiring staking, making them ideal for everyday use.

Prioritize security features such as two-factor authentication and instant alerts. These tools help protect your funds and provide peace of mind while using your card.

What Are Crypto Mastercard Prepaid Cards

How Crypto Prepaid Cards Work

You use crypto Mastercard prepaid cards to spend your digital assets like regular money. These cards connect your crypto wallet to the Mastercard payment network. When you make a purchase, the card provider converts your chosen cryptocurrency into local currency instantly. You do not need to sell your crypto ahead of time. You can use these cards online or in stores, just like any other Mastercard.

Crypto prepaid cards often come with a mobile app. You can track your spending, manage your balance, and choose which cryptocurrency to use for each transaction. Some cards let you freeze or unfreeze your card with a tap. This gives you control and flexibility over your funds.

Benefits of Using Crypto Cards

Crypto cards offer several advantages for everyday spending. You can earn rewards or cashback on your purchases. Many cards support multiple cryptocurrencies, so you can choose which asset to spend. You get the convenience of using your crypto anywhere Mastercard is accepted.

Tip: Crypto cards can help you avoid the hassle of converting crypto to cash through an exchange.

You also benefit from advanced security features. Most crypto cards use two-factor authentication and instant transaction alerts. You can lock your card if you notice suspicious activity. These features protect your assets and give you peace of mind.

Crypto cards make it easy to use your digital assets in the real world. You can travel, shop, and pay bills without worrying about currency conversion or finding a crypto-friendly merchant.

Key Features of the Best Crypto Payment Cards

Rewards and Cashback

Rewards and cashback programs set the best crypto payment cards apart from the rest. You want to maximize your spending by earning back a portion of your purchases. Some crypto cards offer higher rates for specific categories, such as gas or dining, while others provide flat rates on all transactions. These rewards can come in the form of crypto, tokens, or even fiat currency.

You should compare the top options to see which card matches your lifestyle. For example:

KAST Solana Card gives up to 15% cashback, but you need a premium tier that costs over $1,000 per year.

Bybit offers 10% cashback for VIP users.

Crypto.com provides up to 8% cashback if you stake $500,000 in CRO.

Gemini Credit Card stands out with 4% cashback on gas, 3% on dining, 2% on groceries, and 1% on all other purchases, with no staking required.

Note: If you want high rewards without locking up large amounts of crypto, the Gemini Credit Card offers strong rates with no staking.

Fees and Limits

Understanding fees and limits helps you avoid surprises. Crypto payment cards may charge annual fees, transaction fees, or ATM withdrawal fees. Some cards keep costs low, while others require you to pay more for premium benefits. Limits on spending, withdrawals, and wallet balances also affect how you use your card.

Here is a comparison of fees and cashback rates for leading crypto cards:

Card Name | Annual Fee | Transaction Fee | ATM Withdrawal Fee | Cashback Rate |

|---|---|---|---|---|

Nexo Card | $0 | $0 | N/A | Up to 2% in NEXO tokens or 0.5% BTC |

Gemini Credit Card | $0 | $0 | N/A | 4% on gas, 3% on dining, 2% on groceries, 1% on all others |

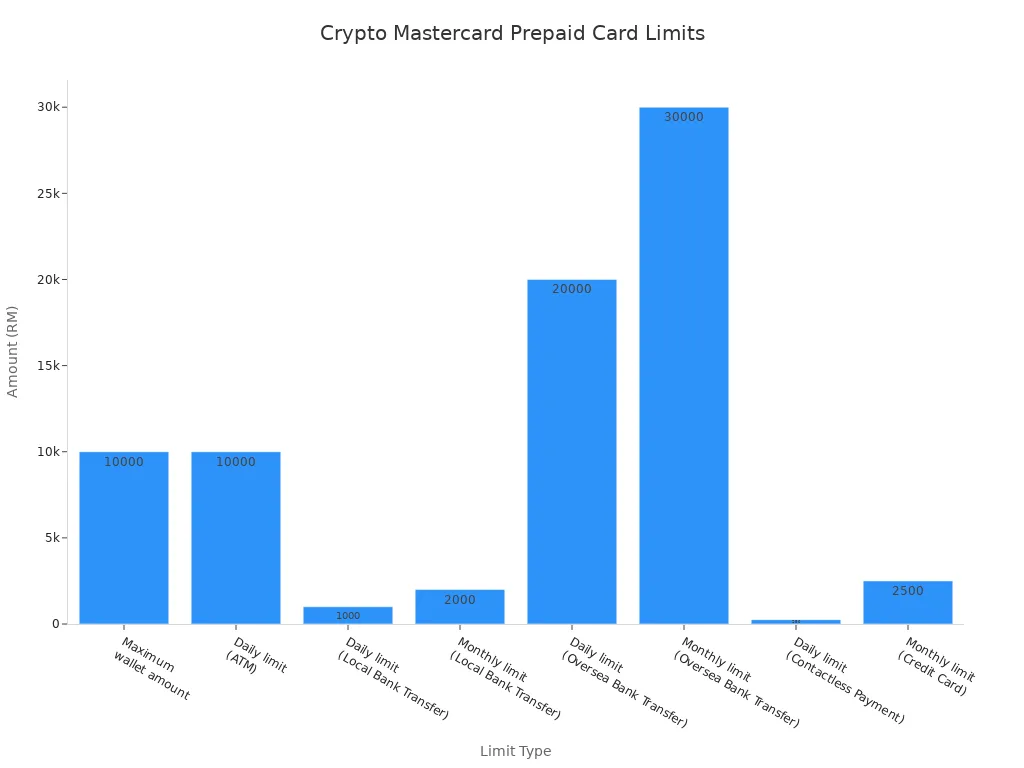

You should also consider spending and withdrawal limits. These limits can affect your daily and monthly usage. For example, some cards set a maximum wallet amount of RM10,000 and daily ATM withdrawal limits of RM10,000 or 10 withdrawals per day. Local and overseas bank transfer limits also apply.

Tip: Always check the card’s terms for hidden fees or restrictions before you apply.

Supported Cryptocurrencies

The range of supported cryptocurrencies determines how flexible your card is. Some crypto payment cards let you spend dozens of coins, while others focus on a few major assets. If you hold a diverse portfolio, you want a card that supports many coins and tokens. This flexibility allows you to choose which asset to spend based on market conditions.

Nexo Card and Binance Card support a wide variety of cryptocurrencies, making them ideal for users who want options. Coinbase Card also covers many popular coins. Gemini Credit Card focuses on a smaller selection but includes top assets like Bitcoin and Ethereum. Crypto.com Card supports a broad range, especially if you use its native CRO token.

Note: If you plan to use altcoins or stablecoins, check the card’s list of supported assets before signing up.

Usability and App Experience

A smooth app experience makes managing your crypto card easy. You want to track spending, switch between assets, and freeze your card instantly if needed. The best crypto payment cards come with user-friendly apps that let you control your funds on the go.

Some of the most highly rated platforms include:

MPay: This app serves as a leading payment solution in Malaysia, offering banking services and retail payments.

KA$H: This integrated e-wallet and debit card app allows for cashless payments, online purchases, and even supports transport, bills, and donations.

Crypto.com and Nexo both offer robust apps with real-time notifications and spending analytics. Gemini and Coinbase also provide intuitive interfaces for managing your crypto debit cards.

Tip: Choose a card with an app that fits your daily habits and offers strong customer support.

Security Features

Security should always be a top priority. Crypto cards protect your assets with features like two-factor authentication, instant transaction alerts, and the ability to lock your card from your phone. These tools help you respond quickly to suspicious activity and keep your funds safe.

Nexo Card and Crypto.com Card both offer advanced security, including biometric login and real-time alerts. Gemini Credit Card uses Mastercard’s global security network for added protection. Binance Card and Coinbase Card also provide strong security measures, giving you peace of mind.

Callout: Always enable all available security features in your card’s app to maximize protection.

Global Acceptance

Global acceptance ensures you can use your card almost anywhere. Mastercard’s network covers millions of merchants worldwide, so you can shop, travel, and pay bills with ease. The best crypto payment cards work seamlessly across borders, letting you spend your crypto wherever you go.

Crypto.com Card and Binance Card stand out for global usability, supporting transactions in many countries. Nexo Card and Coinbase Card also offer broad acceptance, making them reliable choices for frequent travelers. Gemini Credit Card works wherever Mastercard is accepted in the United States and many international locations.

Note: Some cards may have regional restrictions or require you to activate international usage in the app.

By focusing on these features—rewards, fees, supported coins, usability, security, and global reach—you can find the best crypto payment cards for your needs.

Comparing Top Crypto Cards for 2025

Nexo Card Overview

You get a unique experience with the Nexo Card. This card offers both debit and credit modes, letting you switch with a tap. You earn up to 2% cashback in NEXO tokens or 0.5% in BTC when you use Credit Mode. If you keep your balance in Debit Mode, you can earn up to 14% interest. You pay no annual or transaction fees. The card is available in the European Economic Area and the UK. You unlock better rewards and lower borrowing rates if your account balance is above $5,000. Mastercard powers global merchant acceptance, so you can use this card at millions of locations.

Feature | Nexo Card Details |

|---|---|

Type | Hybrid Debit/Credit (physical metal & virtual) |

Cashback/Rewards | Up to 2% in NEXO tokens or 0.5% BTC on Credit Mode purchases; up to 14% interest on idle balance in Debit Mode |

Fees | $0 annual and $0 transaction fees |

Credit APR | 2.9–13.9% |

Availability | EEA and UK only |

Key Features | Dual-mode, interest earnings, loyalty tiers, global merchant acceptance |

Tip: Nexo Card works best for users in Europe or the UK who want flexible spending and interest on idle balances.

Coinbase Card Overview

You use the Coinbase Card to spend crypto cards directly from your Coinbase account. This card supports many popular cryptocurrencies. You earn rewards on every purchase, and you manage your card through a simple app. You pay no annual fee, but some transaction fees may apply. The card is available in select regions. You benefit from Mastercard’s global reach, making it easy to use crypto cards for everyday purchases.

Gemini Credit Card Overview

You choose the Gemini Credit Card if you want strong rewards without staking. You earn up to 4% cashback on gas, 3% on dining, and 2% on groceries. You get 1% on all other purchases. You pay no annual or transaction fees. The card supports top cryptocurrencies like Bitcoin and Ethereum. You manage your card through a user-friendly app. This card suits users who want simple rewards and easy management.

Crypto.com Card Overview

You get a wide range of options with the Crypto.com Card. You earn up to 8% cashback if you stake CRO tokens. The card supports many cryptocurrencies. You pay no annual fee, but higher rewards require staking. You use a robust app to track spending and manage assets. This card fits heavy crypto users who want high rewards and flexibility.

Binance Card Overview

You access one of the largest selections of cryptocurrencies with the Binance Card. Binance supports over 600 digital assets. You use crypto cards for global payments, but regional restrictions may apply. Binance Card is not authorized in some areas, such as Malaysia. You earn rewards on purchases and manage your card through the Binance app.

Supports over 600 cryptocurrencies

Global usability, but limited in some regions

Rewards on purchases

Note: Binance Card suits users who want access to many cryptocurrencies and travel often, but you should check local regulations.

You find that crypto cards offer different benefits for each user type. Everyday spenders may prefer Gemini Credit Card for simple rewards. Heavy crypto users may choose Crypto.com Card or Binance Card for flexibility and asset variety. Nexo Card stands out for users in Europe or the UK who want interest on idle balances and dual spending modes.

Crypto Prepaid Cards Comparison Table

Feature Summary Table

You want a clear view of how the top crypto Mastercard prepaid cards compare. This table helps you see the main features side by side. Use it to spot the differences and choose the card that fits your needs best.

Card Name | Rewards & Cashback | Annual Fee | Supported Cryptos | App Experience | Security Features | Global Acceptance |

|---|---|---|---|---|---|---|

Nexo Card | Up to 2% NEXO or 0.5% BTC | $0 | 60+ | Advanced, flexible | 2FA, instant alerts | EEA, UK, global shops |

Coinbase Card | Up to 4% in crypto | $0 | 9+ | Simple, user-friendly | 2FA, lock card | Select regions |

Gemini Card | Up to 4% (no staking) | $0 | 60+ | Intuitive, fast | Mastercard security | US, some global use |

Crypto.com Card | Up to 8% (with staking) | $0 | 100+ | Robust, feature-rich | Biometric, real-time alerts | Global (some limits) |

Binance Card | Up to 8% (region limits) | $0 | 600+ | Powerful, detailed | 2FA, instant lock | Many countries |

Tip: Look for cards with no annual fee and strong rewards if you want to maximize value.

Nexo Card and Gemini Card offer simple rewards with no staking.

Crypto.com Card and Binance Card support the most cryptocurrencies.

All cards provide strong security and global acceptance, but some have regional restrictions.

You can use this table to match your priorities with the right card. Check which features matter most to you before you decide.

How to Choose the Right Crypto Mastercard Prepaid Card

Matching Card Features to Your Needs

You should start by thinking about your daily habits and how you use crypto spending. If you travel often, you need a card with strong global acceptance and low foreign transaction fees. If you want to earn rewards, look for cards that offer high cashback rates without requiring large staking amounts. Some cards focus on supporting many cryptocurrencies, which helps if you hold a diverse portfolio. Others keep things simple with just a few major coins.

You should also consider how you plan to manage your card. A user-friendly app can make crypto spending easier and safer. Security features like two-factor authentication and instant alerts protect your funds. If you want to earn interest on your balance, choose a card that offers this benefit.

Practical Tips for Selection

You can use these questions to guide your choice:

Do you want to maximize rewards or keep fees low?

Will you use the card for everyday purchases or only for travel?

How many cryptocurrencies do you want to spend?

Does the card support your country or region?

How important is app experience and customer support to you?

Tip: Make a checklist of your top priorities before you apply. This helps you compare cards and find the best fit for your crypto spending style.

You should always read the card’s terms and conditions. This ensures you understand all fees, limits, and requirements before making a decision.

You now know what sets the best crypto Mastercard prepaid cards apart. Focus on rewards, fees, supported coins, and usability. Use the comparison table and tips to guide your choice. Review your needs before you apply. Smart decisions help you get the most value from your crypto card.

FAQ

Can you use a crypto Mastercard prepaid card at any store?

You can use your crypto Mastercard prepaid card anywhere Mastercard is accepted. Always check for regional restrictions before you travel or shop.

Do you need to stake crypto to get rewards?

You do not always need to stake crypto. For example, Gemini Credit Card gives rewards with no staking. Crypto.com Card offers higher rewards if you stake CRO.

What happens if your card is lost or stolen?

You can freeze your card instantly using the app.

Tip: Always enable instant alerts and two-factor authentication for extra security.

See Also

Top Virtual Crypto Card Providers Reviewed for Advantages

Evaluating Leading Crypto Cards for Daily Purchases

Optimal Multi-Currency Crypto Cards for Booking Global Flights