Best Mobile Crypto Cards for Everyday Use and Cashback

You want the best mobile crypto card for daily use and cashback in 2026. UUPAY is special because it gives instant rewards. It has low fees and an easy-to-use app. Crypto.com, Coinbase, Wirex, BitPay, Nexo, Gemini, and Bleap Mastercard have their own cool features. Some let you spend money in different ways or give extra safety.

In 2026, more people are using mobile crypto cards without KYC. This is popular with young people who care about privacy and like using phones. Digitap's no-KYC Visa card lets people pay anywhere in the world. You do not need to show your identity, which makes it very popular.

Look at each mobile crypto card for rewards, fees, and how simple it is to use. Think about how you spend money and what is most important to you when you choose a mobile crypto card.

Key Takeaways

UUPAY and Bleap Mastercard give rewards right away and have low fees. This makes them great for daily use.

When you pick a crypto card, look at cashback rates, fees, and how easy it is to use. This helps you choose the best card for your life.

Mobile crypto cards let you use crypto like cash. They give you more control and freedom with your money.

If you travel a lot, find cards with no foreign fees and free ATM withdrawals.

Always read the rules to know if you can get the card and to not miss any rewards.

Top Mobile Crypto Card Picks 2026

Quick Comparison Table

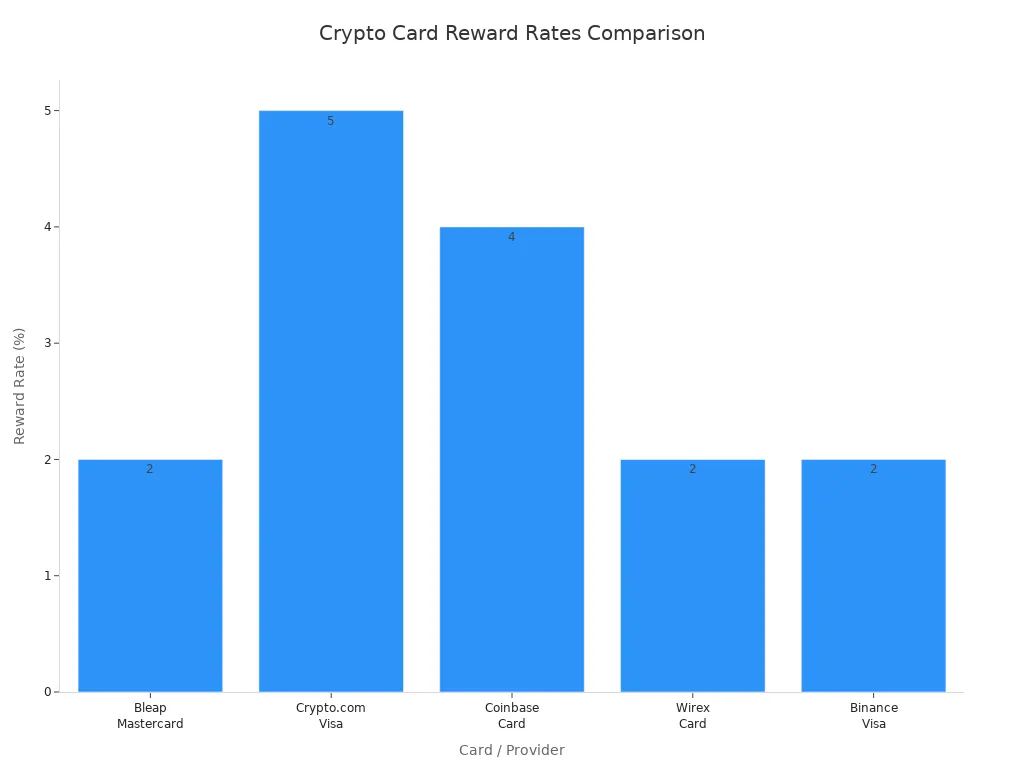

You want to find the best crypto card for your daily spending. Let’s look at the top picks for 2026. These cards stand out for their rewards, low fees, and easy mobile wallet support. Here’s a quick table to help you compare:

Card / Provider | Rewards | Fees | Key Notes |

|---|---|---|---|

Bleap Mastercard | 2% cashback in USDC | No fees | Free card, crypto rewards, full control |

Crypto.com Visa | Up to 5% cashback | FX & top-up fees | High rewards, but complex and costly |

Coinbase Card | Up to 4% crypto rewards | Conversion fees | Trusted brand, but lower net yield |

Wirex Card | Up to 2% cashback in WXT | Monthly fees, FX markups | Wide reach, but fee-heavy |

Binance Visa | Up to 2% cashback | Trading-based fees | Strong brand, but custodial risk |

Tip: When you compare cards, check the reward structures, fees, spending limits, and mobile wallet support. These criteria help you pick the best crypto card for your lifestyle.

Standout Features Overview

Each card has something special. Bleap Mastercard gives you 2% cashback in USDC with no fees. You get full control and easy access. Crypto.com Visa offers up to 5% cashback, but you pay FX and top-up fees. Coinbase Card is simple and trusted, but conversion fees lower your net rewards. Wirex Card works in many places and gives you up to 2% cashback, but monthly fees add up. Binance Visa is strong for trading, but you face custodial risks.

You want the best crypto card for everyday use. Look for instant rewards, low fees, and smooth mobile wallet integration. UUPAY and Bleap Mastercard are great if you want fast payouts and privacy. Crypto.com and Coinbase work well if you want high rewards and trust big brands. The best crypto card for you depends on how you spend and what features matter most.

What Is a Mobile Crypto Card?

How Mobile Crypto Cards Work

A mobile crypto card lets you spend your crypto just like cash. You connect your card to a wallet that holds your crypto or stablecoins. When you buy something, the card changes your crypto into regular money right away. You can use these cards in stores, online, or even at ATMs. You control your funds until you pay. You do not need to wait for a bank to approve your purchase.

You manage everything from your phone. Most cards come with an app. You can check your balance, see your spending, and even freeze your card if you lose it. Some cards do not ask for your ID, so you get more privacy. You can use your card anywhere that accepts Visa or Mastercard.

Everyday Spending Benefits

Mobile crypto cards make daily spending simple and fast. You do not need to move money to your bank first. You just tap, swipe, or shop online. Many cards give you instant cashback or rewards in crypto. You can earn while you spend.

Let’s see how crypto cards compare to regular debit cards:

Aspect | Traditional debit card | |

|---|---|---|

Source of funds | Linked to a wallet holding crypto or stablecoins | Linked to a bank account |

Conversion | Converts crypto into fiat at the moment of payment | Uses existing fiat balance |

Ownership | You control funds until payment | Bank holds and manages your funds |

Access | Works globally with fewer currency barriers | Limited by country and local bank rules |

Fees | Transparent top-up cost, often lower than FX rates | Possible hidden conversion and network fees |

Availability | 24/7 use, borderless | Limited by bank schedules |

Tip: With a mobile crypto card, you can shop worldwide, skip hidden fees, and keep control of your money. You get more freedom and flexibility every day.

Best Crypto Card Comparison: UUPAY, Crypto.com, and More

When you look for the best mobile crypto card, you want to know how each one stacks up. Let’s break down UUPAY, Crypto.com, and other top picks so you can see which card fits your daily needs.

Cashback and Rewards

You probably care most about cashback rewards. These cards give you money back every time you spend. Some cards offer higher rates, but you need to watch for limits and special rules.

Here’s a quick look at the cashback rewards you get from popular cards:

Card Provider | Cashback Rewards |

|---|---|

Crypto.com | 0-8% cashback |

Coinbase | 0.5% cashback |

Wirex | 0.5-8% cashback |

Nexo | 0.1-2% cashback |

UUPAY stands out with instant crypto-to-fiat conversion and fast reward payouts. During their current promotion, UUPAY waives card opening and recharge fees. You get more value for every dollar you spend. UUPAY also runs a referral program. If you invite friends, your commission level goes up. You can earn up to 50% commission, which is great if you have a big network.

Tip: Always check the terms for each card. Some cards offer high crypto cashback, but only for certain types of spending or after you meet special requirements.

Fees and Costs

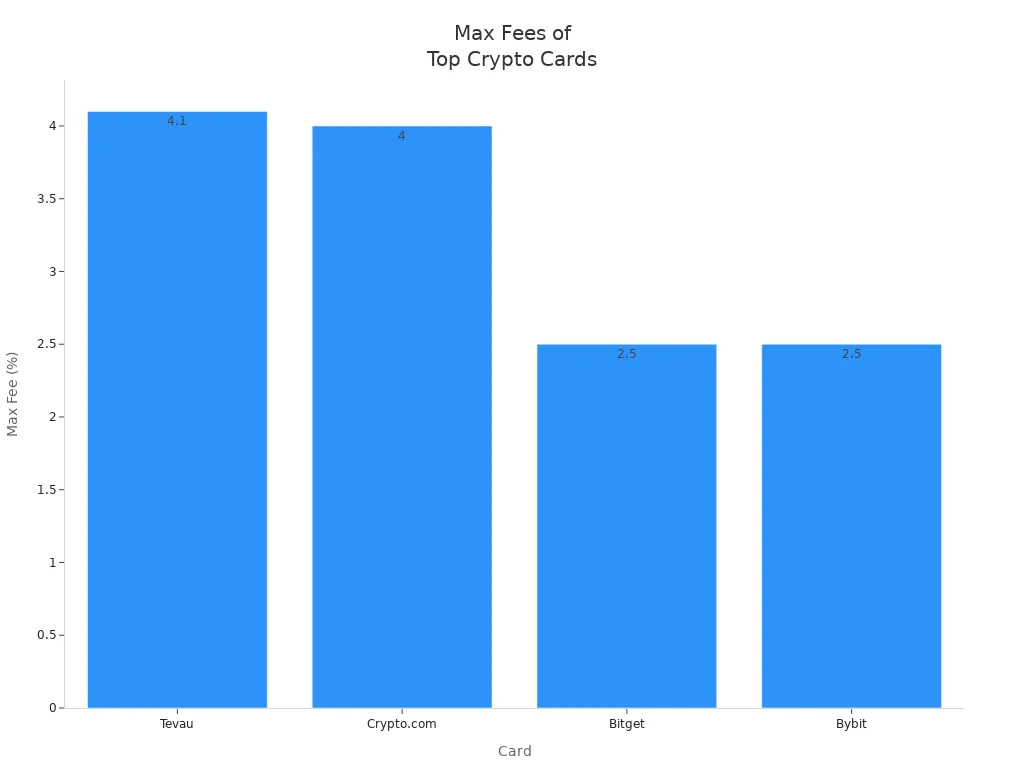

Fees can eat into your rewards. You want a card with low fees so you keep more of your money. Let’s compare the main fees for each card:

Card | Total Max. Fees |

|---|---|

Tevau | 4.1% |

Crypto.com | 0%–4% |

Bitget | ~2.5% |

Bybit | ~2.5% |

UUPAY keeps things simple. You pay only a 1% transaction fee, which is lower than most traditional crypto cards. Many other cards charge 2-3%, and some market solutions go up to 5%. Right now, UUPAY waives card opening and recharge fees, so you save even more.

Some cards have low or no yearly fees.

Other payment gateways may have high yearly costs.

Note: Watch out for hidden fees. Some users report unexpected charges and limits. Always read the fee schedule before you sign up.

App Usability

You want an app that works smoothly and makes managing your card easy. Most top crypto cards offer mobile apps, but not all apps are equal. UUPAY’s app is simple to use. You can check your balance, track spending, and freeze your card with a tap. The app supports instant crypto-to-fiat conversion, so you never wait for your money.

Crypto.com and Coinbase also have strong apps. You get notifications, spending insights, and security controls. Some users complain about technical glitches, especially on older devices. Others say customer support can be slow or unhelpful.

Here are common issues users report:

Complaint Type | Description |

|---|---|

KYC Issues | Endless loops in KYC verification processes. |

Withdrawal Problems | Failures in processing withdrawals. |

Customer Support Challenges | Long wait times and abandonment during support. |

Technical Glitches | Crashes on older devices and deposit glitches. |

Hidden Fees | Users report unexpected fees and limits. |

KYC holds with prolonged verification times.

Issues with deposits and withdrawals.

Poor customer support experiences, including chat drop-offs.

Hidden fees and limits not clearly communicated.

UUPAY tries to solve these problems. You get fast onboarding, clear fee info, and quick support. The app works well on most devices.

Crypto-to-Fiat Conversion

Speed matters when you spend crypto. You want instant crypto-to-fiat conversion so you can pay without waiting. UUPAY gives you this feature. Your crypto turns into cash right when you swipe or tap. Crypto.com and Wirex also offer quick conversion, but some users say there are delays during busy times.

UUPAY stands out for compliance. The company holds a US MSB license, is registered in Hong Kong, has a Swiss license, and is applying for a Brazil license. You get peace of mind knowing your card follows strict rules.

If you want fast payments, low fees, and strong rewards, UUPAY is a top choice. You get instant crypto-to-fiat conversion, easy app controls, and a chance to earn more with their referral program.

Crypto Debit Card Rewards Breakdown

Highest Cashback Offers

You want to get the most out of every purchase. Some cards give you higher cashback rates than others. For example, Crypto.com can offer up to 8% cashback if you meet their requirements. Bleap Mastercard gives you a steady 2% cashback in USDC with no fees. Wirex and Binance also have strong offers, but you need to check if you qualify for the top rates.

Here’s a quick list of what you might see:

Crypto.com: Up to 8% (with staking and tier requirements)

Bleap Mastercard: 2% in USDC (no fees)

Wirex: Up to 8% (with WXT rewards program)

Binance Visa: Up to 2% (based on your BNB holdings)

Tip: Always check the rules for each card. Some cards ask you to hold or stake tokens to unlock the highest cashback.

Reward Payout Methods

You want your rewards fast and easy. Most cards pay out your cashback in crypto, like USDC, BTC, or their own token. Some cards, like UUPAY, send rewards instantly after you spend. Others, like Coinbase, may pay out weekly or monthly.

Here’s how you might get your rewards:

Instant payout to your wallet (UUPAY, Bleap Mastercard)

Weekly or monthly payout (Coinbase, Crypto.com)

Rewards in stablecoins or native tokens

You can track your rewards in the app. Some cards let you swap your rewards for other coins or cash out to your bank.

Terms and Conditions

You need to know the rules before you start earning. Every crypto debit card has terms that affect your rewards. These rules decide if you get the bonus or not. Here’s a table to help you see what matters:

Category | Details |

|---|---|

Eligibility Requirements | You must use a referral code, pass KYC, and complete trades. Your region must support the program. |

30-Day Window | The reward period starts after KYC approval and lasts 30 days. All trades in this time count. |

Trading Volume Calculation | Both buys and sells count. Volume is in USD. You can use crypto, credit card, or fiat. |

Reward Cap | You can earn rewards for up to 100 referrals. The max total reward is $10,000 USD. |

Note: You must keep your account active. If you break the rules or live in a blocked region, you may not get rewards.

You want to read the terms before you sign up. This helps you avoid missing out on rewards.

Fees and Costs of Crypto Debit Cards

Annual and Monthly Fees

When you pick a crypto debit card, you want to know if you will pay yearly or monthly fees. Some cards let you use them for free, while others charge a small amount each month. Bleap Mastercard stands out because it does not charge any annual or monthly fees. Wirex Card, on the other hand, may ask for a monthly payment. Always check the card’s fee schedule before you sign up. If you want to save money, look for cards that offer the lowest fees and no hidden charges.

Transaction and Conversion Fees

Every time you use your crypto card, you might pay a transaction or conversion fee. This fee covers the cost of turning your crypto into regular money. Some cards keep these fees low, while others add extra costs. For example, Crypto.com Visa charges between 0% and 4% depending on your card tier and how much you spend. Coinbase Card usually takes a 1% fee on each transaction. Wirex Card can charge up to 2%. These fees can add up if you use your card often. You should always check the app or website for the latest rates.

ATM and Foreign Fees

You may want to withdraw cash or use your card while traveling. Each card has its own rules for ATM and foreign transaction fees.

Traditional cards often charge 2–3% for foreign transactions.

Here’s a quick look at ATM withdrawal fees for popular crypto cards:

Card Name | ATM Withdrawal Fee |

|---|---|

Bleap Mastercard | Free up to $400/month |

Crypto.com Visa | 1–2% after limit |

Wirex Card | 2% |

Coinbase Card | 1% |

If you travel a lot or use ATMs often, pick a card with low or no fees for these services. This way, you keep more of your money in your pocket.

Everyday Usability and Security

In-Store and Online Payments

You can use mobile crypto cards almost everywhere you shop. Big brands like Burger King and Virgin Galactic take Bitcoin now. More online stores let you pay with crypto each year. The number of companies accepting crypto keeps growing. When you go into a store, you can pay with your phone. You use NFC or QR codes to make payments. These cards work for shopping in stores and online. People like using smartphones for payments. Mobile payments are getting more popular. You get fast payments without touching anything. You have more ways to pay than before.

More stores let you buy things with crypto.

You can use your card in stores or online.

NFC and QR codes help you pay quickly.

You can shop almost anywhere. You do not need cash or worry about changing money.

Mobile Wallet Integration

It is easy to add your crypto card to Apple Pay or Google Pay. You just put the card in your wallet app. You do not need another app to pay. Your card shows your balance and spending right away. Pay It Now’s Web3 Mastercard works like any other Mastercard. It acts as a token card in Apple Wallet and Google Wallet. You get quick and safe payments every time.

Put your card in Apple Wallet or Google Wallet.

Use your phone to pay in stores or online.

See your balance and spending instantly.

Phantom works with Apple Pay and Google Pay. You can buy crypto easily. You skip hard steps and get a smooth payment.

Security Features

You want your money to be safe. Mobile crypto cards use strong security tools. You can freeze your card if you lose your phone. Most apps use two-factor checks and fingerprint login. Your card data is locked and safe. You control your money until you pay. Hackers cannot steal your crypto. Different places have their own safety rules.

Region | Key Considerations | |

|---|---|---|

United Kingdom | Financial Conduct Authority (FCA) | New rules help test services safely. |

European Union | PSD2, GDPR | Extra privacy rules and some limits for UK apps. |

United States | Consumer Financial Protection Bureau, state laws | Rules are complex and change by state. |

Asia-Pacific | Monetary Authority of Singapore, ASIC in Australia, Chinese regulations | Australia needs strict licenses. China has many rules. |

You feel safe because your card follows strong security rules and local laws.

Best Crypto Card for Different Users

For Shoppers

If you love shopping, you want a card that gives you rewards and keeps things simple. You can earn cashback and enjoy low fees with the right card. Take a look at this table to see why many shoppers choose this option:

Feature | Description |

|---|---|

Low Fees | Only 1.7% comprehensive fee, lower than most competitors (2-3%). |

Cashback Rewards | Earn up to 8% APY on staked stablecoins and cashback bonuses in the first 30 days. |

Instant Top-Ups | Allows for quick funding without conversion hassles. |

Global Acceptance | Legally issued through Mastercard in the EU and Visa in Asia. |

User-Friendly | Designed for stablecoin users, making it ideal for frequent shoppers. |

You get fast top-ups and can shop almost anywhere. The app is easy to use, so you can track your spending and rewards.

For Travelers

You travel a lot. You need a card that works worldwide and keeps your costs low. Look for cards with no foreign transaction fees and free ATM withdrawals. Bleap Mastercard and UUPAY both offer global acceptance. You can pay in different countries without worrying about extra charges. These cards help you avoid hidden fees and let you spend like a local. You also get instant notifications, so you always know what you spend.

Tip: Always check if your card supports the countries you visit most.

For Crypto Enthusiasts

You want more than just spending. You want to stake, swap, and use many coins. The Crypto.com Visa Card gives you these features:

You can stake CRO and unlock higher cashback rewards.

You spend both fiat and cryptocurrencies.

The card supports many assets, so you can use your favorite coins.

Oobit lets you spend from your own wallet without staking.

You get flexibility and more ways to earn. If you love crypto, these cards give you the tools you want.

For Beginners

You want something simple and safe. You do not want to worry about seed phrases or hidden fees. This table shows why some cards are perfect for beginners:

Feature | Description |

|---|---|

MPC technology | Enhances security without the need for seed phrases. |

Non-custodial | You control your funds at all times. |

Beginner-friendly setup | Takes less than a minute to set up. |

Integrated Mastercard | Spend anywhere with 2% cashback in USDC. |

No foreign exchange charges, monthly costs, or ATM fees. |

You can set up your card in under a minute. You get strong security and easy rewards. You do not pay extra fees, so you keep more of your money.

You want a mobile crypto card that fits your life. UUPAY and Bleap Mastercard stand out for instant rewards and low fees. Crypto.com works well if you want high cashback and more coins. Before you choose, check these factors:

Factor | Description |

|---|---|

Fees and Charges | Look at all costs, like monthly, transaction, and withdrawal fees. |

Supported Cryptocurrencies | Pick a card that matches your coins. |

Rewards and Cashback | Compare cashback rates and reward programs. |

Security Features | Make sure your card protects your money. |

User Experience | Try the app and see if it feels easy to use. |

If you want to learn more, check out these guides:

Stablecoin & Crypto Cards Explained: Ultimate Crypto Card Guide for 2025 transak.com

The Future of Spending: Understanding Crypto Cards redotpay.com

Pick the card that matches your habits. You get the most when you choose what works for you.

FAQ

What is a mobile crypto card?

A mobile crypto card lets you spend your crypto like cash. You use it in stores, online, or at ATMs. You control everything from your phone.

Can I use my crypto card anywhere in the world?

Yes! Many crypto cards offer global acceptance. You can shop, travel, and pay almost anywhere that takes Visa or Mastercard.

How do I get cashback with a crypto card?

You earn cashback every time you spend. Some cards pay rewards instantly. Others pay weekly or monthly. Check your app for details.

Are crypto cards safe to use?

Crypto cards use strong security. You can freeze your card in the app. Most cards use two-factor checks and fingerprint logins. Your money stays safe.

See Also

Top Crypto Prepaid Cards for Seamless Daily Transactions

Evaluating Leading Crypto Cards for Daily Use

Top Bitcoin Card Options for Daily Purchases

Essential Tips for Using Crypto Cards Daily

Comparing Leading Virtual Crypto Card Providers for Advantages