Advanced guide to crypto debit cards to pay global subscriptions for cross‑border sellers

You want to make global payments simple and fast. Crypto debit cards let you pay for global subscriptions with crypto. You do not need to worry about exchange rate fees or slow bank transfers. Travelers and cross-border sellers enjoy global reach, privacy, and security. See the main advantages of using crypto for business payments:

Benefit | Description |

|---|---|

Speed of Transactions | Cryptocurrency transactions are generally much faster than traditional bank transfers. |

Avoidance of Exchange Rate Fees | Bypass traditional exchange rate fees and fluctuations. |

Enhanced Security and Privacy | Transactions are typically encrypted, sharing only wallet addresses instead of personal details. |

Accessibility and Convenience | Access funds almost anywhere, anytime, as long as there is an internet connection. |

Travelers can use crypto payments at any time. Payment service providers like UUPAY help you reach new markets. You gain global reach, save on fees, and keep your funds secure. The advantages of using crypto support your business as you serve travelers and manage global subscriptions.

Key Takeaways

Crypto debit cards allow you to pay for global subscriptions directly with cryptocurrency, saving time and avoiding the need for currency conversion.

Using stablecoins for payments helps you avoid price volatility and ensures predictable costs for international transactions.

Crypto debit cards offer enhanced security features, such as two-factor authentication, to protect your funds and personal information.

How Crypto Debit Cards Simplify Cross-Border Payments

Direct Crypto Spending for Subscriptions

You want to pay for your global subscriptions without hassle. Crypto debit cards let you spend crypto directly for services like cloud storage, SaaS tools, and streaming platforms. You do not need to convert your crypto to fiat first. This process saves you time and reduces steps in your payment workflow.

Many platforms now accept stablecoin payments. You can use stablecoins to pay for international payments, which helps you avoid price swings. Stablecoin payments give you more control over your spending. You can keep your funds in stablecoins and pay for subscriptions in real time.

Tip: Stablecoin payments help you avoid the volatility of other crypto assets. You can lock in value and make predictable international payments.

Crypto debit cards support a wide range of crypto assets. You can choose to pay with Bitcoin, Ethereum, or stablecoins. This flexibility lets you manage your funds in the way that works best for your business. You can also track your spending through mobile apps, making it easy to manage multiple subscriptions across different countries.

Seamless Currency Conversion

International payments often come with hidden fees and slow processing times. Crypto debit cards solve these problems by offering seamless currency conversion. You can pay for services in any country, and the card provider handles the conversion from crypto to local currency instantly.

Stablecoin payments make international payments even easier. You can hold your funds in stablecoins and spend them anywhere, without worrying about exchange rate swings. This approach gives you a stable value for your cross-border payments.

Let’s compare conversion fees between crypto debit cards and traditional cards:

Card Type | Conversion Fees |

|---|---|

Crypto Debit Card | Usually has conversion or network fees when spending crypto |

Traditional Card | Typically has foreign exchange fees, which can vary by provider |

You can see that both card types have fees, but crypto debit cards often provide more transparency. You know what you pay up front. Stablecoin payments also help you avoid extra charges from currency fluctuations. You can plan your international payments with confidence.

Crypto debit cards let you make crypto payments for subscriptions in any country. You do not need to worry about local banks or currency restrictions. You can use stablecoin payments to settle international payments quickly and securely. This method gives you more freedom and control over your business expenses.

Note: Stablecoin payments are especially useful for cross-border sellers. You can pay vendors, platforms, and service providers worldwide without delays.

Crypto debit cards simplify cross-border payments by letting you spend crypto directly, convert currencies seamlessly, and use stablecoin payments for predictable international payments. You gain speed, transparency, and flexibility for your global business needs.

Key Features of Crypto Debit Cards

Security and Compliance

You want your payments to stay safe. Crypto debit cards use strong security tools to protect your funds. You see two-factor authentication, biometric login, and encrypted transactions. These features help you keep your account secure. You also get compliance with global standards. Card providers follow rules to prevent fraud and money laundering. You benefit from enhanced security and privacy. Your personal data stays private, and your crypto payments remain protected.

Tip: Always turn on security features in your card app. This step helps you stop unauthorized access.

Mobile App Integration

You manage your crypto debit cards with easy-to-use mobile apps. These apps let you check your balance, track spending, and freeze your card if needed. You can set alerts for every transaction. You control your crypto payments from anywhere. Many apps support instant notifications. You see every payment in real time. You also get tools to manage multiple currencies and subscriptions.

Check balances instantly

Track spending across countries

Freeze or unfreeze your card with one tap

Supported Cryptocurrencies

You want flexibility in your payments. Crypto debit cards support many types of crypto. You can use Bitcoin, Ethereum, and stablecoins. Some cards let you choose from dozens of assets. You pick the crypto that fits your needs. You pay for subscriptions, services, and products worldwide. You do not need to convert your crypto before spending. This feature saves you time and gives you more control.

Supported Crypto | Use Cases |

|---|---|

Bitcoin | Global payments |

Ethereum | SaaS subscriptions |

Stablecoins | Price stability |

Crypto debit cards give you security, easy app management, and support for many crypto assets. You gain privacy and control over your global payments.

Benefits for Cross-Border Sellers

Lower Fees and FX Savings

You want to keep more of your profits when you make international payments. Crypto debit cards help you save money on fees and foreign exchange costs. Traditional cross-border payments often take days and charge high fees. With crypto, you can settle payments in under three minutes. You pay much less, usually between 0.5% and 1%, compared to the 2% to 7% charged by banks. Stablecoin payments make it even easier to avoid extra charges from currency swings. You can use stablecoin payments for your global payments and keep your costs low. Research shows that stablecoin payments could save businesses $10 billion by 2030. Travelers and cross-border sellers see the advantages of using crypto for international payments every day.

Fast settlement for international payments

Lower transaction fees for cross-border payments

Stablecoin payments protect you from currency swings

Fast and Accessible Payments

You need to move money quickly and easily. Crypto debit cards give you instant access to your funds. You can use crypto for international payments at any time, even on weekends or holidays. Travelers enjoy the freedom to pay for services worldwide. Stablecoin payments let you send money to anyone, anywhere, without waiting for banks to open. You can use stablecoin payments for subscriptions, vendors, and platforms. Payment service providers make it simple to manage your global payments. You stay in control of your business and reach new markets.

Tip: Use stablecoin payments to avoid delays and keep your business running smoothly.

Rewards and Cashback

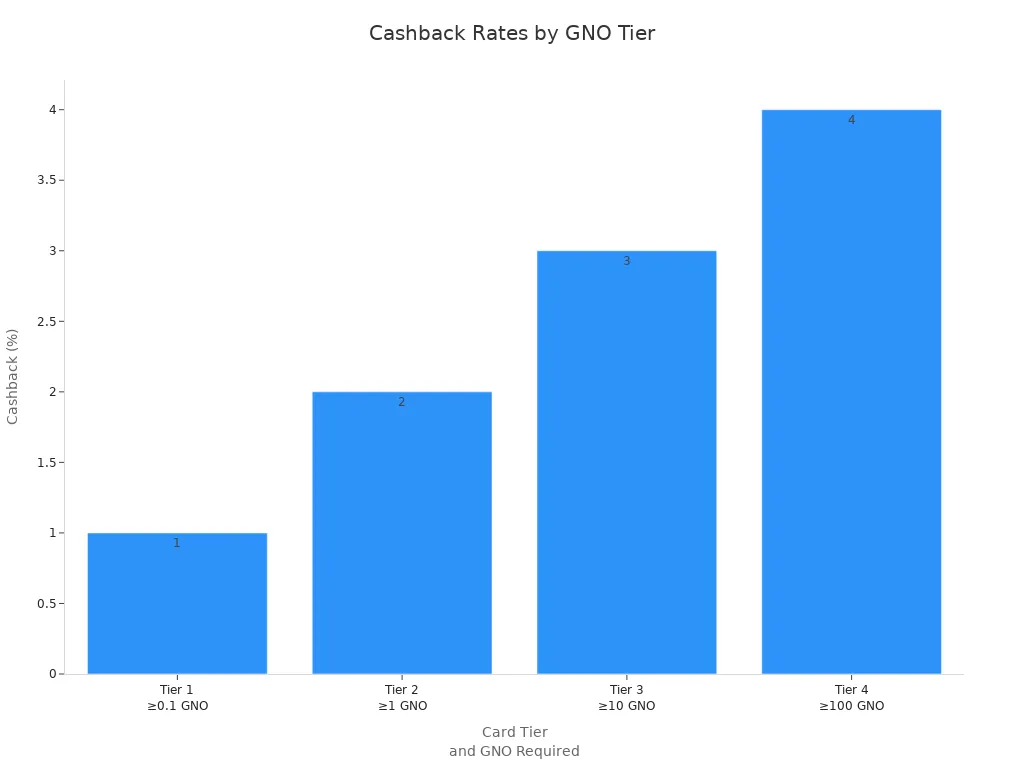

You can earn rewards when you use crypto debit cards for international payments. Many providers offer cashback programs based on your usage. For example, some cards use a tier system with GNO tokens. The more GNO you hold, the higher your cashback rate.

Tier | GNO Required | Cashback Percentage |

|---|---|---|

1 | ≥0.1 GNO | 1% |

2 | ≥1 GNO | 2% |

3 | ≥10 GNO | 3% |

4 | ≥100 GNO | 4% |

You receive cashback automatically every week. Some cards set monthly spending limits, such as EUR 20,000 or USD 22,000. If you hold a special NFT, you can get an extra 1% cashback. Other cards, like Robinhood Gold, boost your cashback on crypto deposits. Travelers and cross-border sellers benefit from these rewards as they pay for subscriptions and services with stablecoin payments and crypto.

Setting Up and Using Crypto Debit Cards

Registration and Verification

You start by choosing a provider for your crypto debit cards. UUPAY gives you a simple registration process. You visit their website or download the app. You enter your email and create a password. You verify your identity with a government-issued ID. You upload a photo and wait for approval. Most travelers finish this step in minutes. You receive a confirmation email when your account is ready.

Tip: Use a strong password and enable two-factor authentication. This step protects your crypto and keeps your account secure.

Funding and Managing Your Card

You fund your card by transferring crypto from your wallet. UUPAY supports Bitcoin, Ethereum, and stablecoins. You select the asset and enter the amount. You confirm the transaction. Your balance updates instantly. You check your spending and manage your card through the mobile app. You freeze or unfreeze your card with one tap. Travelers track expenses and set alerts for every payment. You see all your transactions in real time.

Action | How to Do It |

|---|---|

Add crypto | Transfer from your wallet |

Check balance | Use the mobile app |

Freeze card | Tap in the app |

Set alerts | Enable notifications |

Linking to Global Subscriptions

You link your crypto debit cards to global subscriptions. You enter your card details on platforms like SaaS tools, streaming services, or cloud storage. You choose crypto as your payment method if available. You set up automatic payments for cross-border payments. Travelers use stablecoins for predictable costs. You enjoy the advantages of using crypto for global payments. You manage subscriptions from anywhere and avoid delays.

Note: Review your subscriptions monthly. This habit helps you control spending and spot unwanted charges.

Overcoming Challenges in Crypto Payments

Managing Volatility

You face price swings when you use crypto for international payments. Stablecoin payments help you avoid this problem. Stablecoins keep their value steady, so you do not worry about sudden drops. Travelers often choose stablecoin payments for global subscriptions. You can hold stablecoins in your wallet and pay for services without stress. Crypto debit cards let you switch between assets, so you can move funds to stablecoins when you need stability. You protect your business from losses and keep your costs predictable.

Tip: Use stablecoin payments for regular international payments. You gain peace of mind and avoid surprises.

Navigating Regulations

You must follow rules when you use crypto for international payments. Each country has its own laws. Travelers need to check local rules before making crypto payments. Some places require extra verification. You should pick providers that follow global standards. UUPAY helps you meet compliance needs. You get support for KYC and AML checks. Stablecoin payments often make it easier to meet these rules. You keep your business safe and avoid legal trouble.

Regulation Area | What You Should Do |

|---|---|

KYC | Verify your identity |

AML | Watch for suspicious activity |

Tax | Track your crypto payments |

Ensuring Transaction Security

You want to keep your crypto safe. Crypto debit cards use strong security tools. You see two-factor authentication and biometric login. Travelers trust these features for privacy and safety. Stablecoin payments add another layer of protection. You can freeze your card if you spot a problem. You get alerts for every transaction. Crypto payments stay secure when you use trusted providers. You control your funds and protect your business.

Note: Always turn on security features in your app. You keep your crypto safe and your international payments secure.

Choosing the Right Crypto Debit Card

Key Selection Criteria

You want a crypto debit card that fits your business and travel needs. Start by looking at the fees. Some cards charge for transactions, while others offer free payments. Check if the card supports the crypto assets you use most. You may need Bitcoin, Ethereum, or stablecoins for your global subscriptions. Security should always come first. Look for cards with two-factor authentication, biometric login, and strong encryption. These features protect your funds and personal data.

You should also consider how easy it is to manage your card. A good mobile app lets you track spending, freeze your card, and get alerts. Many travelers need cards that work in many countries. Make sure your card provider supports cross-border payments. Rewards and cashback programs can add extra value. Some cards give you bonuses for using crypto for everyday purchases.

Tip: Always read the terms and conditions before you choose a card. This step helps you avoid hidden fees and surprises.

Comparing Providers

You have many choices for crypto debit cards. Each provider offers different features. The table below shows how top cards compare:

Card Name | Fees | Supported Assets | Security Features |

|---|---|---|---|

Gnosis Pay Card | No transaction fees | Various cryptos | Self-custodial, high security |

ether.fi Cash | 0.01 ETH to 1 ETH annually | Multiple tokens | Non-custodial, full asset control |

Solayer Emerald Card | Minor top-up and transaction fees | USDC | On-chain payments, yield earning |

MetaMask Card | Varies by card type | Multiple tokens | Integrates with mobile wallets |

KAST Card | Free to premium tiers | Multi-chain support | SOL staking rewards, APY on staked assets |

You see that some cards focus on low fees, while others offer more crypto choices or advanced security. Travelers often pick cards with wide asset support and strong protection. UUPAY stands out for cross-border payments. You get fast setup, support for many crypto assets, and robust security. Many travelers trust UUPAY for global subscriptions and everyday spending.

Note: Choose a card that matches your crypto habits and travel plans. The right card makes your payments simple and secure.

Real-World Success Stories

Cross-Border Seller Case Studies

You can learn a lot from real sellers who use crypto debit cards for global subscriptions. One seller from Brazil runs an online store that ships to Europe and Asia. She uses crypto to pay for cloud storage and marketing tools. She chooses stablecoin payments to avoid price swings. Her crypto debit card lets her pay for services in different countries. She does not worry about exchange rates or delays. Another seller in Nigeria uses crypto for cross-border payments. He pays for SaaS subscriptions and web hosting. He values privacy and fast transactions. He uses stablecoin payments to keep his costs steady. His crypto debit card helps him manage expenses and track spending.

You can see how crypto makes international payments simple. Sellers use crypto debit cards to save time and money.

Lessons Learned

You should focus on best practices when you use crypto for your business. Choose stablecoin payments for regular bills. This step helps you avoid surprises from price changes. Always check the fees before you make a payment. Use the mobile app to track your spending. Set alerts for every transaction. Protect your privacy by using strong passwords and two-factor authentication. Review your subscriptions each month. You can freeze your card if you see a problem. Crypto gives you control and flexibility. You can pay for services worldwide and keep your business running smoothly.

Best Practice | Why It Matters |

|---|---|

Use stablecoins | Avoid price swings |

Track spending | Manage your budget |

Enable security | Protect your privacy |

You can see that crypto helps you handle cross-border payments with ease. Sellers who use crypto debit cards gain speed, security, and control.

You can simplify global subscriptions with crypto debit cards. Crypto gives you fast payments, lower fees, and strong privacy. You manage crypto payments easily and protect your business. Choose a trusted provider like UUPAY. Start using crypto for cross-border payments and see how crypto helps your business grow.

FAQ

How do you get started with crypto for travel?

You open an account with a provider. You fund your card with crypto. You learn how to use crypto while traveling for daily expenses and global business payments.

What are tips for travelers considering crypto payments?

Always check if your destination accepts crypto. Booking your travel with crypto can save you money. Using crypto for daily travel expenses gives you more flexibility.

Can you use crypto debit cards for global business subscriptions?

Yes. You can pay for services worldwide. Crypto debit cards help you manage global business costs and subscriptions with ease.

See Also

A Beginner's Guide to Understanding Crypto Debit Cards

Top Strategies for Using Crypto Cards for Global Flights

Using Multi-Currency Crypto Cards for Lazada Purchases in Thailand

How to Use Multi-Currency Crypto Cards for Ad Payments in Indonesia

Effective Methods for Paying Lazada with Crypto Debit Cards in Malaysia