Beginner guide to crypto debit cards to convert crypto for daily spending for global travelers

Imagine strolling through a bustling street market in Tokyo or grabbing coffee in Paris, all without worrying about currency exchange. Crypto debit cards let you turn your crypto into everyday spending power, no matter where your travels take you. You just swipe, tap, or withdraw—crypto does the rest! This complete guide promises to turn your travel wallet into a digital powerhouse.

Key Takeaways

Crypto debit cards allow you to spend digital currencies like Bitcoin and Ethereum anywhere, making travel easier and more convenient.

Choose the right card by comparing features such as supported cryptocurrencies, fees, and rewards to enhance your travel experience.

Instant conversion at the point of sale means you can buy local goods without worrying about currency exchange rates.

Always check for ATM access and fees in your destination to avoid unexpected costs when withdrawing cash.

Using stablecoins can help minimize price fluctuations and keep your spending predictable while traveling.

How Crypto Debit Cards Work

Bridge Between Crypto and Real-World Spending

You hold crypto in your digital wallet, but you want to buy a slice of pizza or a train ticket. How do you make that leap from digital coins to real-world goods? Crypto debit cards act as your bridge. You load your card with crypto, and the card connects directly to global payment networks. When you swipe your card at a store, the magic happens behind the scenes. The card takes your crypto and turns it into the local currency, so you can pay for anything from souvenirs to street food.

Crypto payment cards let you spend bitcoin, stablecoins, and other digital assets just like regular money. You don’t need to worry about finding a crypto-friendly shop. The card handles the conversion, so you can focus on your adventure. You get the freedom to use your crypto anywhere, anytime.

Global Acceptance: Visa, Mastercard, and Bitcoin ATMs

You might wonder, “Will my crypto debit card work everywhere?” The answer is almost always yes! Most crypto payment cards run on major networks like Visa or Mastercard. That means you can use them at millions of locations worldwide. Whether you’re shopping in New York, eating noodles in Bangkok, or booking a hotel in Rome, your card works just like any other debit card.

Some cards even let you withdraw cash from Bitcoin ATMs. Imagine standing in front of an ATM in Berlin, tapping your card, and getting euros straight from your crypto wallet. You don’t need to hunt for a currency exchange booth or carry wads of cash. Crypto payment cards make global spending easy and stress-free.

Tip: Always check if your card supports ATM withdrawals in your destination country. Some places have more Bitcoin ATMs than others!

Instant Conversion for Daily Purchases

The real magic of crypto debit cards lies in instant conversion. You don’t have to plan ahead or guess how much local currency you’ll need. When you make a purchase, the card instantly converts your crypto into the right fiat currency for the vendor. Here’s how the process works:

Step | Description |

|---|---|

1 | A purchase is made using the crypto debit card. |

2 | The card converts the cryptocurrency into fiat currency. |

3 | The vendor is paid in their preferred currency. |

4 | The converted amount is deducted from the user's crypto wallet. |

5 | The total amount in the wallet is updated accordingly. |

You get to spend your crypto on coffee, groceries, or even a new pair of shoes. The vendor receives their payment in dollars, euros, yen, or whatever currency they prefer. You see the updated balance in your wallet right away. Crypto payment cards keep things simple and fast.

With a bitcoin debit card, you can use bitcoin for daily spending without any hassle. Crypto payment cards support a wide range of coins, so you can pick your favorite. You don’t need to worry about exchange rates or hidden fees. The card takes care of everything, letting you enjoy your travels and your crypto.

Getting Started with Crypto Cards for Travelers

Ready to turn your crypto into a travel superpower? Let’s walk through the steps to get your crypto cards for travelers up and running. You’ll go from curious explorer to crypto spending pro in no time. Grab your digital wallet and let’s dive in!

Choosing the Right Card (UUPAY and Others)

You stand at the crossroads of adventure and convenience. The first step? Pick the best crypto cards for travelers. Not all cards are created equal. Some offer juicy rewards, others focus on low fees, and a few shine with global acceptance.

UUPAY stands out for global travelers. It offers seamless spending, supports multiple cryptocurrencies, and works in over 200 countries. You can also find other options like KazePay and Crypto.com, but UUPAY’s flexibility and worldwide reach make it a top pick for those who want to start spending without borders.

Tip: Compare features like supported coins, ATM access, and cashback perks before you choose. The right crypto spending card can make your journey smoother.

Signing Up and Verification

You’ve picked your card. Now, it’s time to sign up! The process feels a bit like joining a secret club, but with more selfies and fewer secret handshakes. Most crypto cards for travelers require you to verify your identity. This keeps your funds safe and meets global regulations.

Here’s what you’ll usually need:

Requirement Type | Examples |

|---|---|

Personal Information | Full name, Date of birth, Address, Email, Phone number |

Government-issued ID | Passport, Driver’s license |

Proof of Address | Utility bill, Bank statement |

Additional Verification | Selfie or video selfie, Social Security Number, Income source information |

You fill out your details, upload your documents, and snap a quick selfie. The platform checks everything. Once you pass, you’re ready to start spending like a crypto globetrotter.

Funding Your Card from Wallet or Exchange

Your card is ready, but it needs fuel. Time to load it up! Crypto cards for travelers let you fund your card straight from your wallet or exchange. The process feels like topping up a prepaid phone, but with digital coins instead of minutes.

Here’s how you can fund your card:

Sign up on your chosen platform (like UUPAY or KazePay).

Link your crypto wallet to your account.

Deposit the cryptocurrency you want to use for spending.

Hold multiple coins—Bitcoin, Ethereum, and stablecoins all work great.

Many travelers use stablecoins for everyday spending. Stablecoins keep your balance steady, even if the crypto market goes wild. You can also use Bitcoin or Ethereum, but stablecoins help you avoid surprises when you start spending abroad.

Practical tips for beginners: Always double-check the wallet address before sending funds. Mistakes can be costly!

Requesting and Activating Your Card

You’ve funded your card. Now, you need the magic plastic (or virtual card) in your hand. Requesting your card is easy. Most platforms let you choose between a physical card for ATM withdrawals and a virtual card for online shopping.

Follow these steps to activate your card and start spending:

Log in to your account and request your card.

Wait for delivery (physical card) or get instant access (virtual card).

Activate your card through the app or website.

Set your PIN and security preferences.

Start spending at stores, online, or even at Bitcoin ATMs.

You can use stablecoins for everyday spending, grab a coffee, or pay for a train ticket. The world opens up when you start spending with crypto cards for travelers. If you want to maximize your crypto spending, keep an eye on fees and always look for practical tips for beginners.

Practical tips for beginners: Activate notifications for every transaction. You’ll track your crypto spending and spot any issues fast.

With these steps, you’re ready to join the ranks of global adventurers who use crypto cards for travelers. The journey from sign-up to start spending feels smooth, secure, and a little bit magical.

Spending Cryptocurrency Abroad

Making Purchases In-Store and Online

You step into a bakery in Rome. The smell of fresh bread fills the air. You pull out your crypto payment card and pay for a croissant. The card handles the conversion from bitcoin or stablecoins to euros in seconds. You walk away with a treat and a smile. Spending cryptocurrency feels just like using any regular card. You can shop for souvenirs, book tours, or grab a quick snack. Crypto payment cards work for both in-store and online payments. You can buy train tickets, order food delivery, or even pay for a museum ticket—all with your crypto. Everyday use becomes a breeze, and you never worry about carrying cash.

International Withdrawals and Bitcoin ATMs

You find yourself in Tokyo, low on yen. No problem! Crypto payment cards let you make international withdrawals at ATMs. Some cards even work with bitcoin ATMs. You insert your card, select the amount, and the machine spits out local currency. The conversion happens instantly. You can use your crypto for payments anywhere you travel. You avoid long lines at currency exchange booths. You keep your travel light and your wallet happy.

Tip: Always check ATM fees before making withdrawals. Some international ATMs charge extra for conversion.

Rewards and Cashback Benefits

Who doesn’t love rewards? Crypto payment cards turn spending cryptocurrency into a game where you win every time. Many cards offer cashback on every purchase. You buy a coffee, you get cashback. You pay for a hotel, you get more cashback. Some cards even give extra rewards for international payments or specific merchants. You rack up rewards points, crypto cashback, or even bitcoin as you travel. The more you use your card, the more rewards you collect. You can track your rewards in the app and watch your balance grow. Crypto payment cards make everyday spending fun and rewarding. You get to enjoy your trip and earn rewards at the same time. That’s a win-win for every traveler!

Key Considerations for Crypto Cards

Supported Cryptos and Fiat Currencies

You want your crypto card to work everywhere, right? Before you pack your bags, check which coins your card supports. Most leading cards let you spend the big names. Here’s what you’ll usually find:

BTC

ETH

Other crypto assets (varies by card)

You can also use your card for payment in many fiat currencies. This means you can buy gelato in euros, pay for sushi in yen, or grab a burger in dollars. The card handles the exchange for you, so you just focus on the fun.

Fees, Exchange Rates, and Limits

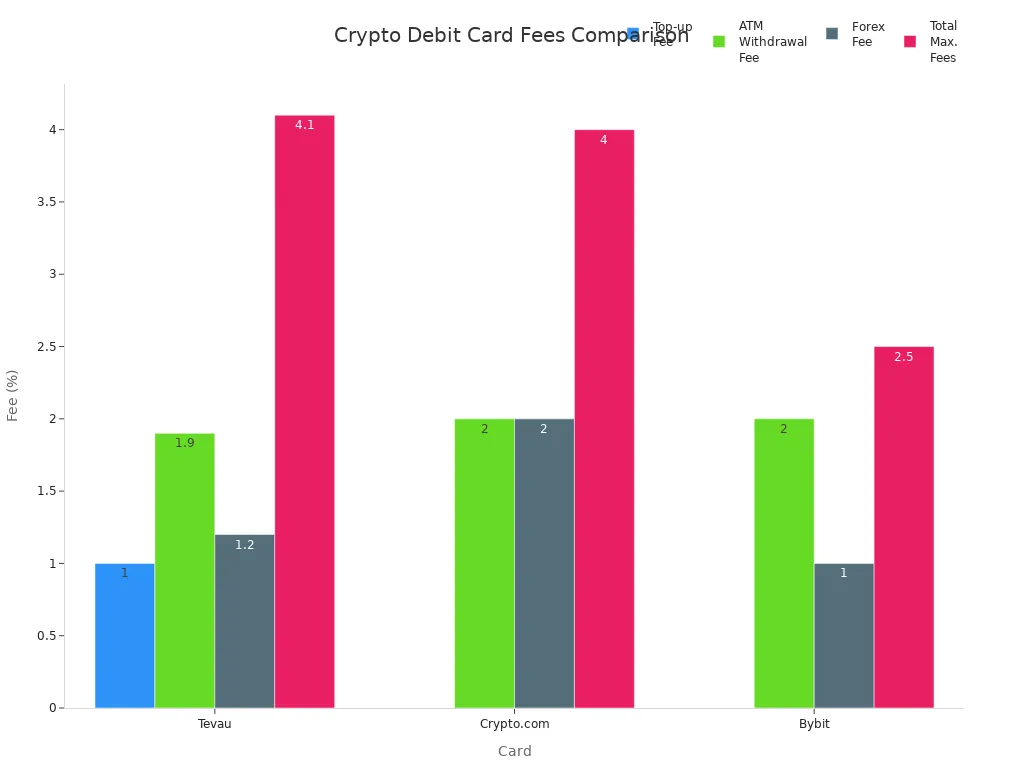

Nobody likes surprise fees. Crypto cards come with their own set of charges for payment, exchange, and ATM withdrawals. Some cards offer free top-ups, while others take a small bite each time you load up. Exchange rates can change fast, so always check before you pay. Here’s a quick look at how some popular cards compare:

Card | Top-up Fee | ATM Withdrawal Fee | Forex Fee | Total Max. Fees |

|---|---|---|---|---|

Tevau | 1% | 1.9% | 1.2% | 4.1% |

Crypto.com | Free (staking required) | Varies by tier (up to 2%) | 0%–2% | 0%–4% |

Bybit | Free | 2% | ~1% | ~2.5% |

Tip: Set your spending limits in the app. This helps you avoid going over budget or running into payment trouble.

Security and Fraud Protection

You want your crypto safe while you travel. Look for cards with strong security features. Two-factor authentication, instant payment alerts, and card freezing options keep your funds protected. If you spot a strange payment, freeze your card with one tap. Many cards also use advanced encryption to keep your payment details private.

Regulatory Compliance for Travelers

Travelers need to play by the rules. Crypto cards must follow local laws for payment and exchange. You’ll need to verify your identity before you start spending. Some countries have strict rules about crypto, so check the regulations before you go. This keeps your payment experience smooth and legal.

Note: Always read the fine print. Each card has its own rules for payment, exchange, and spending abroad.

Crypto Debit Cards vs. Traditional Cards

Advantages for Global Travelers

You love adventure. You want your money to keep up with you. Crypto debit cards give you superpowers that traditional cards just can’t match. Take a look at how they stack up:

Advantage | Crypto Debit Cards | Traditional Cards |

|---|---|---|

Foreign Transaction Fees | Low or no fees | Often high fees |

Currency Conversion | Real-time conversion at point of sale | Poor exchange rates |

Currency Management | Spend multiple currencies from one account | Limited to one currency |

Security | Advanced fraud prevention and blockchain security | Standard security measures |

Rewards | Cashback in cryptocurrency, potential appreciation | Focus on airline miles |

With a crypto card, you skip the long lines at currency exchange booths. You pay in any country without worrying about hidden fees. You get rewards in crypto, and those rewards might even grow in value while you travel. Your card uses blockchain security, so you can relax and enjoy the journey.

Enables borderless payments with low fees

Eliminates the need for pre-travel currency exchanges

Provides peace of mind with enhanced security features

Offers rewards in cryptocurrency that can appreciate in value

Drawbacks and Limitations

Crypto debit cards sound magical, but they have a few quirks. Sometimes, you face spending limits or ATM withdrawal caps. Not every country welcomes crypto with open arms. If you lose internet access, topping up your card can get tricky. Some cards charge fees for certain transactions or conversions. You also need to keep an eye on crypto prices. The value of your balance can jump up or down faster than a roller coaster.

Note: Always check the rules for your destination. Some places have strict crypto regulations.

UUPAY’s Unique Features

UUPAY steps up for global travelers. You get support for multiple cryptocurrencies, so you can pick your favorite. UUPAY works in over 200 countries, making it a true travel companion. You enjoy instant conversion, low fees, and strong security. UUPAY even offers cashback in crypto, so your spending can turn into savings. With UUPAY, you travel smarter, spend easier, and keep your crypto working for you.

Practical Tips for Spending Crypto

Minimizing Fees and Using Stablecoins

You want to keep more money for gelato, not lose it to sneaky fees. Start by choosing stablecoins for your crypto debit card. Stablecoins act like a superhero sidekick. They keep your spending steady and shield you from wild price swings. You never have to worry about your lunch costing double because of market chaos. Stablecoins also make cross-border payments smoother and cheaper. You skip the drama of currency conversion and enjoy lower transaction costs. Before you travel, check which stablecoins your card supports. Load up with USDT or USDC, and watch your spending stay predictable.

Tip: Always review your card’s fee table. Some cards charge for ATM withdrawals or currency swaps. Pick the card with the lowest fees for your travel style.

Tracking Transactions and Budgets

You want to know where your crypto goes. Budgeting apps make this easy. Spendee connects to your crypto wallet and shows your spending in colorful charts. You see every croissant, cab ride, and museum ticket at a glance. Spendee even lets you share wallets with travel buddies, so you can split expenses without arguments. Money Lover helps you create separate wallets for each trip. It tracks recurring payments, scans receipts, and shows exchange rates. You stay organized and never lose track of your crypto. These apps turn budgeting into a game you can win.

App | Features |

|---|---|

Spendee | Crypto wallet integration, shared wallets |

Money Lover | Multiple wallets, receipt scanning |

Tax Implications for Travelers

Crypto spending feels fun, but taxes can sneak up on you. Every time you use crypto for purchases, you might trigger a taxable event. Some countries want you to report gains or losses. Keep records of your transactions. Use your budgeting app to export reports. If you travel often, check the tax rules for each country you visit. You stay out of trouble and keep your adventures stress-free.

Note: Consult a tax professional if you feel lost. They help you navigate the crypto jungle.

Top Crypto Cards for Travelers

UUPAY Card Overview

You want a card that feels like a magic key for your adventures. UUPAY steps up with a crypto card that works almost everywhere. You can spend Bitcoin, Ethereum, or stablecoins with just a tap. UUPAY gives you instant conversion, so you never worry about exchange rates. You get global mastercard acceptance, which means you can buy gelato in Rome or sushi in Tokyo without missing a beat. UUPAY also offers crypto cashback on every purchase. You spend, you earn, and your rewards grow while you travel. The app lets you track your spending and freeze your card if you lose it. UUPAY keeps your crypto safe and your journey smooth.

Other Leading Providers

You have choices when it comes to crypto cards. Crypto.com offers a sleek card with rewards and no annual fees. You can use their app to manage your crypto and see your spending in real time. KazePay gives you flexible funding options and supports many coins. Bybit’s card lets you withdraw cash at ATMs and spend online or in stores. Each provider brings something special to the table. Some focus on low fees, while others shine with extra perks or easy top-ups. You can pick the card that matches your travel style and crypto needs.

Comparing Features and Perks

You want to know which card wins the race. Here’s a quick look at how top crypto cards stack up:

Card | Supported Coins | Cashback | ATM Access | Special Perks |

|---|---|---|---|---|

UUPAY | BTC, ETH, USDT | Yes | Yes | Instant conversion, app |

Crypto.com | Many | Yes | Yes | No annual fee, rewards |

KazePay | Many | No | Yes | Flexible funding |

Bybit | Many | No | Yes | Easy withdrawals |

Tip: Always check the latest features before you choose. Crypto cards update often, and new perks pop up all the time!

You can travel the world and spend your crypto like a local. The right card turns your digital coins into real-world adventures.

You now hold the keys to spending crypto around the world! Crypto debit cards let you turn digital coins into daily adventures. You pick your favorite card, complete a quick KYC check, and choose between virtual or physical cards. Look for rewards like 0.5% to 8% cashback, and decide if you want Bitcoin, Ethereum, or stablecoins. UUPAY and similar cards make travel spending easy. Ready to explore? Pack your crypto card and let your next trip become legendary! 🌍✨

FAQ

How do crypto debit cards help travelers spend crypto abroad?

You get to skip the money changers! Crypto debit cards let travelers pay for gelato, train rides, or souvenirs using bitcoin or ethereum. The card does a live crypto-to-fiat exchange at checkout. You just tap and go. No more hunting for currency exchange booths.

Can I earn travel rewards with crypto rewards cards?

Absolutely! Many crypto rewards cards offer travel rewards. You rack up points or cashback every time you spend. Some cards even give you extra perks for international purchases. Travelers love watching their rewards pile up while exploring new places.

Which cryptocurrencies can I use with these cards?

You can use popular coins like bitcoin and ethereum. Some cards let travelers spend stablecoins or other altcoins. Always check which coins your card supports before you load up. Ethereum works great for daily spending and is accepted by most top cards.

Are crypto debit cards safe for travelers?

Yes! You get security features like instant card freezing, two-factor authentication, and payment alerts. Travelers can relax knowing their funds stay protected. If you lose your card, just freeze it in the app. Safety first, adventure second!

What should travelers know about fees and limits?

Travelers should always check the fee table before using their card. Some cards charge for ATM withdrawals or currency swaps. Set your spending limits in the app. This helps you avoid surprises and keeps your ethereum and other coins safe for the next adventure.

See Also

A Beginner's Guide to Understanding Crypto Debit Cards

Simple Tips for Using Crypto Cards in Daily Life

Comprehensive USDT Visa Card Guide for Digital Nomads