Crypto Visa Card Rewards and Benefits Side by Side

Looking for the best crypto visa card? You want rewards that really help you, right? These cards let you use crypto to buy groceries, gas, or coffee. You earn rewards every time you buy something. You get real benefits when you spend money every day. So, it is important to pick the right card.

Tip: Check rewards rates, coins you can use, fees, and perks before you pick one.

Key Takeaways

Crypto visa cards help you get rewards when you buy things like groceries and gas. Pick a card that matches how you spend money.

Check the rewards rates, which cryptocurrencies you can use, and the fees before you pick a card. Cards with higher rewards may have special rules.

Some cards give cool extras like free streaming or airport lounge access. Find other benefits that make your card better.

If you use your crypto visa card every day, you can earn rewards faster. Using it more means you get more crypto.

Know the risks of crypto rewards, like prices changing a lot and possible fees. Make smart choices to get the most from your card.

Crypto Visa Card Comparison Table

Rewards Rates Overview

You want to know how much you can earn with each card. Here’s a quick look at the top crypto visa card options:

Card Name | Rewards Rate |

|---|---|

UUPAY Crypto Visa Card | Up to 3% on all purchases |

Crypto.com Visa Card | Up to 5% (with CRO stake) |

Coinbase Card | Up to 4% on select purchases |

BlockFi Rewards Visa | 1.5% crypto rewards |

Gemini Credit Card | Up to 4% on purchases |

You can see that some cards give you higher rewards if you stake or hold their token. Crypto.com Visa Card stands out with up to 5% back, but you need to stake CRO. Gemini and Coinbase also offer strong rates. BlockFi gives you a steady 1.5% in crypto rewards.

Note: Crypto rewards can change in value because crypto prices go up and down. This makes them different from regular cash-back cards.

Supported Cryptocurrencies

Each card lets you earn and spend different types of crypto. For example, Crypto.com Visa Card supports many coins like Bitcoin, Ethereum, and CRO. Gemini Credit Card lets you pick from over 60 cryptos for your rewards. Coinbase Card gives you options like Bitcoin, Ethereum, and more. UUPAY and BlockFi focus on popular coins, so you can earn rewards in the crypto you like most.

Fees and Costs

Fees matter when you pick a card. Here’s a quick comparison:

Aspect | Crypto Visa Cards | Traditional Rewards Credit Cards |

|---|---|---|

Funding Source | Draw from crypto holdings | Use a line of credit |

Purpose | Spend crypto easily | Earn rewards on fiat spending |

Fees and Interest | May have conversion or network fees | Charge interest and late fees if unpaid |

Some crypto cards, like Crypto.com, have zero foreign exchange fees. Others may charge small network or conversion fees when you spend your crypto. You usually don’t pay interest because you use your own crypto, not borrowed money.

Unique Perks

You get more than just rewards. Some cards offer perks like free Spotify or Netflix, airport lounge access, or instant crypto rewards. Crypto.com Visa Card gives you these benefits if you stake more CRO. Gemini Credit Card lets you choose your crypto for rewards. UUPAY focuses on fast rewards and easy spending. Each card has its own style, so you can pick the one that fits your life.

Tip: Compare the rewards, supported crypto, fees, and perks to find the best card for your needs.

Top Crypto Visa Card Rewards Breakdown

UUPAY Crypto Visa Card

You want a card that makes earning rewards simple. UUPAY Crypto Visa Card gives you up to 3% back on every purchase. You don’t need to worry about complicated rules or categories. You just spend and earn. You can choose popular crypto for your rewards, so you get what you like most. UUPAY focuses on fast payouts, so you see your rewards quickly. You also get easy access to your crypto for everyday spending. If you want a card with straightforward benefits and perks, UUPAY is a strong choice.

You get rewards every time you use your card. UUPAY makes it easy to spend crypto and earn more.

Crypto.com Visa Card

Crypto.com Visa Card stands out if you want high rewards. You can earn up to 5% back, but you need to stake CRO tokens to unlock the best rate. The more CRO you stake, the higher your rewards. You can earn rewards in many types of crypto, like Bitcoin, Ethereum, and CRO. Crypto.com Visa Card also gives you perks like free Spotify, Netflix, and airport lounge access if you stake enough CRO. You pay zero foreign exchange fees, so you save money when you travel. You get instant rewards after every purchase, which makes spending fun.

Up to 5% rewards with CRO staking

Wide choice of crypto for rewards

Extra perks for high stakers

No foreign exchange fees

Coinbase Card

Coinbase Card lets you earn up to 4% back on select purchases. You can choose which crypto you want for your rewards, like Bitcoin or Ethereum. You spend directly from your Coinbase account, so you don’t need to move your crypto around. Coinbase Card makes it easy to track your rewards in the app. You get instant notifications every time you earn. You don’t pay annual fees, but you might see small conversion fees when you spend. If you already use Coinbase, this card fits right into your daily routine.

You control your rewards. Pick your favorite crypto and watch your balance grow.

BlockFi Rewards Visa

BlockFi Rewards Visa gives you 1.5% back in crypto on every purchase. You don’t need to worry about categories or limits. You earn rewards in Bitcoin, so you build your crypto stack with every swipe. BlockFi also offers bonus rewards for certain spending, like 3.5% back for the first three months. You don’t pay annual fees, and you get your rewards every month. BlockFi makes it easy to use your crypto for everyday needs. If you want steady rewards and simple benefits, BlockFi is a good pick.

1.5% crypto rewards on all spending

Bonus rewards for new users

No annual fee

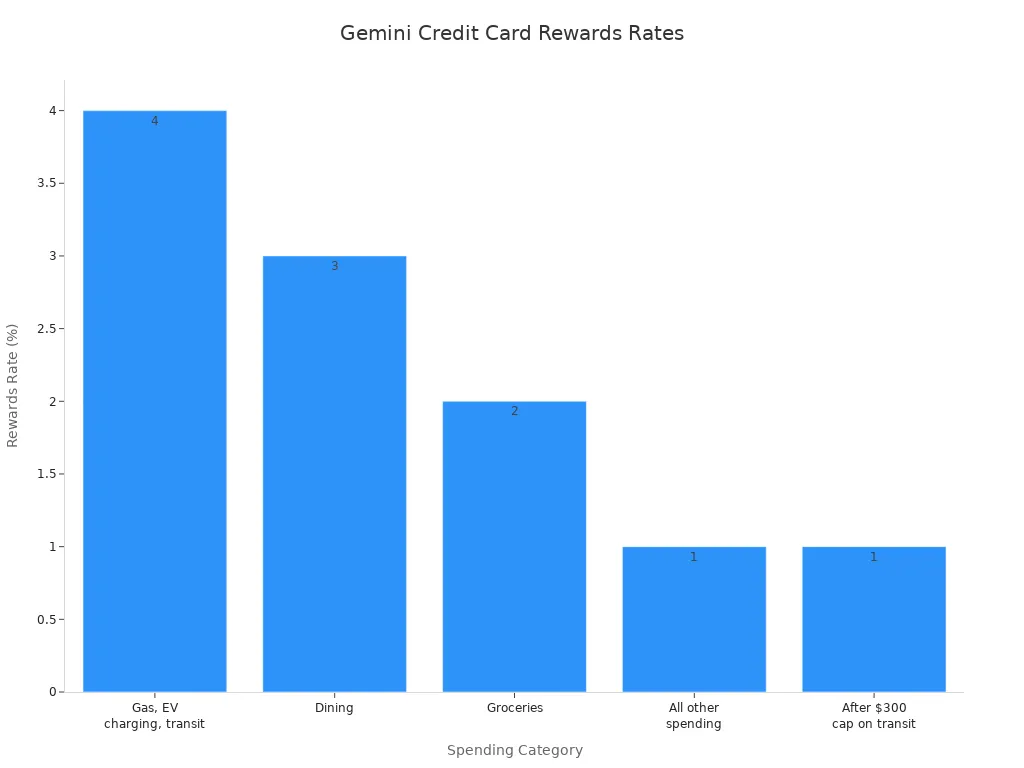

Gemini Credit Card

Gemini Credit Card gives you rewards for every type of spending. You earn 4% back on gas, EV charging, transit, taxis, and rideshare (up to $300 each month). You get 3% back on dining, 2% on groceries, and 1% on everything else. After you hit the $300 cap for transit, you earn 1% for the rest of the month. You can choose from over 60 types of crypto for your rewards. Gemini pays your rewards instantly, so you see them right away.

Here’s a quick look at the rewards rates:

Spending Category | Rewards Rate |

|---|---|

Gas, EV charging, transit, taxis, rideshare | |

Dining | 3% |

Groceries | 2% |

All other spending | 1% |

After $300 cap on transit spending | 1% |

You don’t pay annual fees or foreign transaction fees. You also get your crypto rewards with no extra charges. Standard fees only apply if you sell or convert your crypto. Gemini Credit Card gives you flexibility and instant rewards, so you always know what you’re earning.

No annual fee

No foreign transaction fees

No fees to receive crypto rewards

Gemini Credit Card gives you strong rewards and easy access to your favorite crypto. You get benefits every time you spend.

Everyday Spending with Crypto Visa Cards

How to Earn Rewards on Purchases

You want to make the most out of your crypto visa card. Every time you pay for something, you can earn rewards. You just need to use your card for everyday spending. Groceries, gas, and even your morning coffee count as purchases. The more you use your card, the more rewards you collect.

Let’s look at how different card tiers help you earn rewards:

Card Tier | |

|---|---|

Standard | 4 points |

Premium | 5 points |

Gold | 6 points |

Gold Card holders get 50% more points. If you want to boost your rewards, you can upgrade your card tier. You don’t need to do anything special. Just use your card for everyday purchases and watch your points grow.

Use your crypto visa card for everyday purchases to collect points.

Gold Card holders earn 50% more points.

Tip: Try to use your card for all your daily purchases. You will see your rewards add up fast.

Spending Crypto for Daily Needs

You can use your crypto for almost anything. You pay for lunch, buy clothes, or fill up your car. Your crypto visa card makes everyday spending simple. You don’t need to worry about converting crypto before you shop. The card does it for you.

When you earn rewards, you get extra crypto in your account. You can use these rewards for more purchases or save them for later. Some cards even give you perks like instant payouts or special benefits when you spend more. Earning crypto feels easy when you use your card for everyday spending.

You don’t have to change your routine. Just swipe your card and enjoy earning crypto. Everyday purchases become a way to grow your rewards. You get the benefits of spending and earning at the same time.

Note: Earning crypto on everyday spending helps you build your balance while enjoying your daily life.

Pros and Cons of Earning Crypto Rewards

Advantages of Crypto Rewards

You probably want to know why earning crypto rewards is exciting. When you use a crypto visa card, you get more than just points. You collect rewards in crypto, which can grow in value over time. If the price goes up, your rewards become worth more. You also get instant crypto rewards, so you see your balance increase right away. This feels different from waiting for cash-back or miles to show up.

You can pick the crypto you like best. Some cards let you choose from Bitcoin, Ethereum, or even dozens of other coins. You get flexibility and control over your rewards. Many cards offer perks like no foreign transaction fees or bonus rewards for certain spending. You might even get extra benefits, such as free streaming services or airport lounge access.

Tip: Earning crypto can help you build a digital wallet for the future. You enjoy perks now and possibly bigger rewards later.

If you already use crypto, these cards make it easy to spend and earn more. You don’t need to convert your coins before shopping. You just swipe and go. Crypto visa cards turn everyday purchases into a way to grow your digital assets.

Potential Drawbacks

Earning crypto rewards sounds great, but you should know about the risks. Crypto prices can change quickly. If the market drops, your rewards in crypto might lose value. Some people like the chance for bigger rewards, but others worry about losing money.

Here are a few things to watch out for:

Crypto is volatile. Your rewards can go up or down fast.

Tax rules can get tricky. In the US, new tax laws may affect how you report your crypto rewards. You might need to pay taxes when you use or sell your crypto.

If you don’t like risk, crypto rewards might not feel safe.

Some cards have rules about which coins you can use for rewards.

You may face small network or conversion fees when spending crypto.

Note: If you care about taxes or want stable rewards, you might prefer traditional credit card rewards. Crypto-based cards can offer better tax treatment for some users, but you should check the rules before you start earning crypto.

Crypto visa cards give you cool benefits, but you need to think about the risks. Make sure you understand how rewards in crypto work before you choose a card.

Choosing the Best Crypto Credit Card

Matching Card Features to Your Needs

You want a card that fits your life. Crypto credit cards come with different rewards, fees, and perks. Some cards give you cashback, while others focus on uncapped rewards or a big welcome bonus. You should look at how you spend. Do you travel a lot? Do you buy groceries every week? Maybe you want a convenient way to spend crypto for everything.

Start by checking the rewards program. Some cards offer the highest rewards rate if you spend more or join a special program. Others give you a welcome bonus when you first spend with the card. If you like cashback rewards, pick a card that pays you back every time you spend. Some cards let you earn a bonus for certain types of spending, like dining or travel.

You also need to check the fees. Some crypto credit cards have no annual fee, but others might charge for special perks. Look at the supported coins. If you want to earn Bitcoin, Ethereum, or another crypto, make sure the card supports it. The best cards for earning crypto let you choose your favorite coins and give you instant rewards.

Tip: Write down your top three spending habits. Match them to the card that gives you the most rewards for those things.

UUPAY’s Recommendations

You might wonder which card is best for you. Here are some ideas based on how you spend:

Travelers: Pick a card with no foreign transaction fees and a strong welcome bonus. Crypto.com Visa Card is a good choice for travel perks and uncapped rewards.

High Spenders: Look for the highest rewards rate and a program with bonus cashback. Gemini Credit Card and Coinbase Card offer great cashback rewards and uncapped rewards.

Crypto Investors: Choose a credit card that earns crypto in your favorite coins. UUPAY Crypto Visa Card and BlockFi Rewards Visa focus on simple programs and fast payouts.

Everyday Spenders: Go for a card with easy cashback and a welcome bonus. UUPAY and Gemini both give you instant rewards and a convenient way to spend crypto.

You should always compare the program details, fees, and supported coins. The best cards for earning crypto help you spend, earn, and save at the same time. Crypto credit cards make it easy to spend and get rewarded, so you can enjoy every purchase.

You have seen how each crypto visa card offers different rewards and perks. Some cards give you more crypto for travel, dining, or everyday spending. You should use the comparison table to find the best fit for your needs. Think about how you want to earn crypto and what benefits matter most. Before you apply, check your eligibility and read user reviews. Picking the right card helps you earn more crypto every time you spend.

FAQ

What is a cryptocurrency Visa card?

A cryptocurrency Visa card lets you use crypto like cash. You can shop in stores or online with it. You pay with crypto from your wallet. The card changes your crypto into money for you.

How do I earn rewards with a cryptocurrency Visa card?

You get rewards each time you buy something with your card. The card gives you some crypto back after you spend. Some cards give more rewards if you stake tokens or spend a lot. You can see your rewards in the card’s app.

Tip: Use your card for daily shopping to earn more crypto rewards.

Can I choose which cryptocurrency I get for rewards?

Yes, most cards let you pick your favorite crypto for rewards. You can choose Bitcoin, Ethereum, or another coin. Some cards have many choices, so you can grow your crypto collection as you shop.

Are there any fees with cryptocurrency Visa cards?

You might pay small network or conversion fees when you spend crypto. Some cards do not charge yearly or foreign fees. Always look at the card’s fee chart before you sign up. You should know what you will pay to use your crypto.

Fee Type | Possible Cost |

|---|---|

Annual Fee | $0 - $100 |

Conversion Fee | 0.5% - 2% |

Foreign Fee | $0 |

Is spending cryptocurrency safe with these cards?

Spending crypto with Visa cards is safe if you use trusted companies. The card uses strong tech to keep your crypto safe. Keep your card and account info secret. If you lose your card, tell support right away.

See Also

Top Virtual Crypto Card Providers Reviewed for Advantages

Key Features of Leading Prepaid Crypto Mastercard Options

Prepaid Crypto Visa Card Choices Available for Malaysians