how to get a crypto card

You can get a crypto card by choosing a provider, checking if you meet eligibility requirements, preparing your documents, applying, and then activating your card. Crypto cards let you spend digital assets for daily purchases, making crypto more practical and accessible.

Many people want to know how to get a crypto card as adoption grows.

Visa managed over $140 billion in crypto and stablecoin flows since 2020.

Major financial firms now support multiple stablecoins and global card programs.

Crypto cards help you use cryptocurrencies for everyday transactions, bridging the gap between digital assets and traditional payments. You should match card features to your needs and always consider security.

Key Takeaways

Choose a crypto card provider that fits your needs. Compare features like supported cryptocurrencies, fees, and rewards.

Prepare necessary documents like a government ID and proof of address before applying. This speeds up the application process.

Complete the Know Your Customer (KYC) verification to ensure your account is secure and compliant with regulations.

Look for cards with low fees and strong security features, such as two-factor authentication, to protect your assets.

Take advantage of promotions, like UUPAY's no issuance fee, to save money when getting your crypto card.

what are crypto cards

definition and basics

Crypto cards let you use digital assets for everyday spending. You can pay for groceries, online shopping, or travel with these cards. Most crypto cards work like regular debit or credit cards, but they connect to your cryptocurrency wallet instead of a bank account. You can choose from virtual or physical cards, depending on your needs. Virtual cards work well for online purchases, while physical cards suit in-person transactions.

Crypto cards bridge the gap between digital currencies and traditional payment systems. You gain access to global merchants and can manage your assets more flexibly.

Many providers offer crypto cards with different features. Some cards support multiple cryptocurrencies, while others focus on popular coins like Bitcoin or Ethereum. You should compare features such as supported coins, spending limits, and rewards before choosing a card.

how crypto payment cards work

Crypto payment cards use technology to convert your digital assets into local currency at the time of purchase. When you swipe or tap your card, the provider instantly exchanges your cryptocurrency for fiat money. Merchants receive payment in their local currency, so they do not need to handle digital assets.

For example, the partnership between Crypto.com and Triple-A enables direct payments in cryptocurrencies. The system converts your crypto into fiat currency instantly. Merchants get paid in their local currency the next day. This process protects merchants from price swings and simplifies accounting.

You can use crypto payment cards almost anywhere that accepts major card networks. Some cards offer extra features like cashback, travel perks, or mobile payment support. You should look for cards with strong security measures, such as two-factor authentication and spending controls.

Card Type | Use Case | Security Features |

|---|---|---|

Virtual Card | Online shopping | Two-factor authentication |

Physical Card | In-store purchases | PIN protection |

Crypto cards make it easier for you to spend digital assets and enjoy the benefits of modern payment technology.

how to get a crypto card: steps

choosing the right card (UUPAY and others)

You need to start by comparing crypto card options. Look at the best crypto card providers, such as UUPAY, Crypto.com, and Binance. Each provider offers different features, including supported cryptocurrencies, rewards, and security measures. UUPAY stands out with its current promotion: no card issuance fee, recharge fees as low as 1%, and no annual fee. During the year-end holiday event, you can open a card without paying any fees and enjoy free recharge.

When you choose a card, consider whether you want a virtual or physical card. Virtual cards work well for online purchases, while physical cards suit in-person purchases. Some cards offer both, giving you flexibility for crypto spending. You should also check if the card supports instant crypto-to-fiat conversion, which lets you use your digital assets for purchases without delays.

Tip: Match the card features to your daily needs. If you travel often, look for global acceptance and mobile payment support. If you shop online, a virtual card may be enough.

eligibility and requirements

You must meet certain requirements before you apply for crypto payment cards. Most providers require you to complete Know Your Customer (KYC) verification. This process helps prevent fraud and keeps your account secure. You need to prove your identity, age, and residency. Most crypto cards require you to be at least 18 years old and live in a supported country.

Regulations vary by region. For example:

Singapore regulates the issuance of credit and charge cards, which are defined as articles intended for purchasing goods or services on credit.

Many providers follow strict rules to protect users and comply with local laws.

You should check the eligibility criteria for each provider. Some cards only support residents of specific countries. Others may have additional requirements, such as a minimum balance or supported cryptocurrencies.

preparing documents

You need to prepare your documents before starting the application. Most crypto card providers ask for:

A government-issued ID (passport or driver’s license)

Proof of address (utility bill or bank statement)

A selfie or photo for identity verification

Gather these documents in advance to speed up the process. Make sure your documents are clear and up to date. If you apply for a crypto debit card, you may need to provide extra information, such as proof of income or employment.

Note: Accurate documents help you avoid delays and ensure a smooth application for crypto payment cards.

application process

You can apply for a crypto card online. UUPAY makes the process simple and fast. First, create an account on the UUPAY platform. Next, upload your documents for KYC verification. UUPAY reviews your information and approves your application if you meet all requirements.

During the year-end promotion, UUPAY waives the card issuance fee and recharge fee. You can open your card and start using it for purchases without extra costs. Other providers may charge fees for card issuance or account setup, so compare the best crypto card options before you apply.

Most platforms let you choose between a virtual or physical card. Virtual cards are issued instantly and ready for online purchases. Physical cards are mailed to your address and can be used for in-store purchases.

Step | What You Do | Timeframe |

|---|---|---|

Create Account | Register on provider’s website | 5-10 minutes |

Upload Documents | Submit ID and proof of address | 10-20 minutes |

KYC Verification | Provider reviews your documents | 1-3 days |

Card Selection | Choose virtual or physical card | Instant/Shipping |

Activation | Activate card for purchases | Instant/Upon arrival |

card issuance and activation

After approval, you receive your crypto card. Virtual cards are available instantly for online purchases. Physical cards arrive by mail and require activation. You can activate your card through the provider’s app or website. UUPAY supports instant crypto-to-fiat conversion, so you can use your card for purchases right away.

You should set up security features, such as PIN protection and two-factor authentication. These features help protect your account and make crypto spending safer. Once activated, you can use your card for daily purchases, online shopping, and travel.

Reminder: Always review the card’s features and security settings before you start using it for crypto spending.

Crypto cards make it easy to use digital assets for purchases. By following these steps, you learn how to get a crypto card and enjoy the benefits of instant crypto-to-fiat conversion, global acceptance, and flexible payment options.

comparing features of top crypto cards

When you look at crypto cards, you want to focus on comparing features that matter most for your daily spending. This comparison helps you find the best crypto payment cards for your needs. You should check supported cryptocurrencies, cashback rewards, fees, security features, and how easy it is to use your card worldwide.

supported cryptocurrencies

You want a card that supports the coins you use most. Some cards only support Bitcoin, while others let you spend many types of crypto. Here is a quick comparison:

Card Provider | Supported Cryptocurrencies |

|---|---|

UUPAY | Many coins |

Binance Card | Bitcoin and other coins |

Coinbase Card | Bitcoin and other coins |

Gemini Credit Card | Bitcoin |

Nexo Card | Bitcoin and other coins |

UUPAY stands out by supporting many coins, which gives you more flexibility in spending and managing your assets.

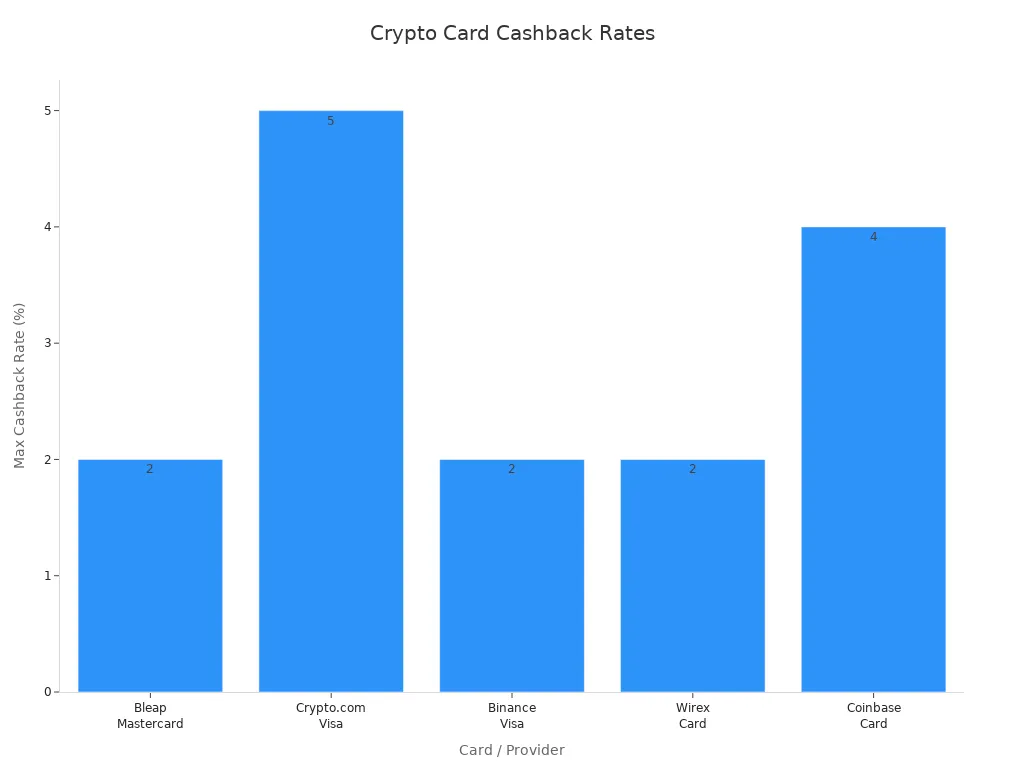

rewards and cashback

Cashback rewards comparison is key when you want to maximize value from your spending. Some cards offer high cashback rates, while others give you instant crypto rewards. You can see the best cashback rewards and crypto rewards in the table below:

Card / Provider | Rewards | Cashback Rate | Conditions | Payout Asset |

|---|---|---|---|---|

Bleap Mastercard | Crypto Cashback | 2% | No conditions | USDC |

Crypto.com Visa | Tiered Rewards | Up to 5% | Requires CRO staking | CRO Token |

Binance Visa | Trading-based | Up to 2% | Based on monthly volume | BNB |

Wirex Card | Token Cashback | Up to 2% | Subscription tiers | WXT |

Coinbase Card | Crypto Rewards | Up to 4% | Varies by asset | BTC / ETH |

You can earn cashback on every purchase, and some cards pay out in crypto. The cashback percentage and payout asset vary, so check the details before you choose.

fees and costs

Fees can affect your spending and rewards. UUPAY offers a strong advantage with no card issuance fee, recharge fees as low as 1%, and no annual fee. During the year-end event, you pay zero for card opening and recharge. Other cards may charge for card issuance, monthly maintenance, or ATM withdrawals. Always compare the total cost before you decide.

Tip: Low fees mean you keep more of your cashback and crypto rewards.

security features

Security features protect your assets and spending. Look for cards with two-factor authentication, PIN protection, and instant card freezing. UUPAY and other top providers use advanced security to keep your funds safe.

mobile payments and global use

You want a card that works for both online and in-store spending. The best crypto cards support mobile payments, so you can use your phone for purchases. Most cards work worldwide, letting you spend crypto anywhere major cards are accepted. This seamless global spending makes travel and shopping easier.

By comparing features like supported coins, cashback, fees, and security, you can find the right card for your lifestyle. Focus on what matters most to you, whether it is high cashback rates, instant crypto rewards, or low fees.

tips for choosing the best crypto card

matching features to your needs

You want the best crypto card that fits your lifestyle. Start by listing your spending habits. Do you shop online or travel often? Some crypto cards offer virtual options for online purchases, while others provide physical cards for in-store use. Compare features like supported cryptocurrencies, global acceptance, and cashback rewards. If you value flexibility, choose a card that supports many coins. Look for rewards that match your spending patterns. UUPAY’s current promotion gives you benefits such as no card issuance fee and recharge fees as low as 1%. During the year-end event, you can open a card and recharge without paying extra fees. These features help you save money and maximize your rewards.

Tip: Make a table of your priorities. List what matters most, such as low fees, high cashback, or easy mobile payments.

security and support

Security should be your top concern when selecting the best crypto card. You need strong protection for your assets. Look for platforms that use encryption and secure sockets layer (SSL) technology. Two-factor authentication adds another layer of safety. Reliable customer support is also essential. Choose providers that offer 24/7 support through chat, email, or phone. Quick help can solve problems and keep your account safe.

Encryption protects your transactions.

Two-factor authentication secures your login.

SSL technology keeps your data private.

24/7 support helps you resolve issues fast.

avoiding common pitfalls

Many users make mistakes when choosing crypto cards. You can avoid these pitfalls by staying informed. Read the terms and conditions before applying. Watch out for hidden fees, such as monthly maintenance or ATM withdrawal charges. Some cards limit the types of cryptocurrencies you can use. Always check the list of supported coins. Make sure you understand how rewards work and how to redeem them. If you travel, confirm that your card works globally.

Note: Review all card features and benefits before making your final choice. This step helps you avoid surprises and ensures you get the best crypto card for your needs.

crypto card fees and comparison

application and maintenance fees

You want to keep costs low when choosing a crypto card. Application and maintenance fees can add up quickly. UUPAY stands out with its lowest fees. You pay no card issuance fee, no annual fee, and recharge fees as low as 1%. During the year-end event, UUPAY waives both card issuance and recharge fees. This promotion helps you save money and maximize your rewards.

Compare UUPAY’s fee structure with other leading providers. The table below shows how application and maintenance fees differ:

Card Provider | Application Fee | Maintenance Fee | Transaction Fee | Withdrawal Fee |

|---|---|---|---|---|

UUPAY | Free | None | As low as 1% | Varies |

Bybit | Free | None | 0.9% - 3% | N/A |

1inch Card | N/A | None | 2% | 0.4% - 0.5% |

You see that UUPAY offers low fees and competitive features. Bybit and 1inch Card also provide low fees, but UUPAY’s special event gives you extra savings.

transaction and ATM fees

Transaction fees affect your daily spending. You pay a fee each time you use your crypto card for purchases or withdrawals. UUPAY keeps transaction fees low, starting at 1%. Bybit charges between 0.9% and 3%. 1inch Card charges 2% for transactions and up to 0.5% for withdrawals.

Compare crypto card fees with traditional cards:

Card Type | Fee Range | Additional Notes |

|---|---|---|

Cryptocurrency Card | 0.9% to 3% | Fees depend on transaction currency, location, and conversion needs. |

Traditional Card | Varies widely | Often includes annual fees, foreign transaction fees, and other accumulating charges. |

You benefit from low fees with crypto cards, especially when you choose providers like UUPAY. You also enjoy cashback rewards and flexible payment options.

avoiding extra charges

You can avoid extra charges by following smart strategies. Use cryptocurrency for certain transactions to skip hefty fees or delays. Always check the fee schedule before making purchases or withdrawals. Choose cards with low fees and transparent policies.

Use crypto for international payments to reduce conversion fees.

Review your card’s terms to avoid hidden charges.

Select providers with clear fee structures and strong rewards.

Tip: Pick a card with the lowest fees and best features for your needs. UUPAY’s current promotion helps you save even more during the year-end event.

You stay ahead by comparing fees and choosing the right card. Focus on low fees, strong features, and generous cashback rewards to get the most value from your crypto card.

You can get crypto cards by following these steps:

Register with your chosen provider.

Complete identity verification.

Access the card application page and select your region.

When you compare crypto cards, review fees, supported assets, and user experiences. UUPAY’s year-end promotion gives you no card issuance fee and recharge fees as low as 1%. Always choose regulated exchanges and look for strong security features. Protect your privacy with portable identity and private key authentication. Start your application and enjoy secure, flexible spending.

FAQ

What is a crypto card?

A crypto card lets you spend cryptocurrencies like regular money. You can use it for shopping, travel, or online payments. The card converts your crypto into local currency at checkout.

How do I apply for a UUPAY crypto card?

You register on the UUPAY platform, upload your ID and proof of address, and complete KYC verification. During the year-end event, you pay no card issuance or recharge fees.

Are there any fees for using a UUPAY crypto card?

UUPAY offers no card issuance fee, recharge fees as low as 1%, and no annual fee. The year-end event gives you free card opening and free recharge during the promotion.

Can I use a crypto card for international purchases?

Yes, you can use most crypto cards worldwide. You pay with crypto, and the card converts it to local currency. This makes travel and online shopping easier.

What documents do I need to get a crypto card?

You need a government-issued ID, proof of address, and sometimes a selfie for verification. Prepare these documents before you apply to speed up the process.

See Also

How To Purchase Cryptocurrency Using Your Credit Card

A Beginner's Guide To Understanding Crypto Debit Cards

Evaluating Top Crypto Cards For Daily Transactions

Key Advantages Of Leading Prepaid Crypto Mastercard Options

Comparative Analysis Of Leading Virtual Crypto Card Providers