Top 8 Crypto Cards to Use in Malaysia This Year

Looking for the best way to spend crypto in malaysia? Check out these top 8 cards: UUPAY, Oobit, Bybit, RedotPay, Nexo, Crypto.com, Binance, and BitPay. Each malaysia crypto card gives you cool features, low fees, and great rewards. Pick the one that fits your lifestyle and spending habits.

Key Takeaways

Choose a crypto card that fits your lifestyle. Consider factors like supported cryptocurrencies, fees, and rewards.

Look for cards with low fees and cashback options. Cards like Bybit and Crypto.com offer significant rewards on purchases.

Always check the latest fee schedules and card availability in Malaysia before applying. This ensures you understand costs and can access the card.

Malaysia Crypto Card Comparison

Choosing the right malaysia crypto card can feel overwhelming. You want something easy to use, with low fees and good rewards. To help you out, here’s a quick look at the best crypto debit cards you can use in Malaysia this year.

Key Features Table

Card | Issuer | Fees | Rewards | Supported Cryptos |

|---|---|---|---|---|

UUPAY | UUPAY | Low/Promo Free | Cashback | 10+ |

Oobit | Oobit | Low | Cashback | 5+ |

Bybit | Bybit | Low | Up to 10% Back | 30+ |

RedotPay | RedotPay | Low | Points | 20+ |

Nexo | Nexo | No Annual Fee | Up to 2% Back | 40+ |

Crypto.com | Crypto.com | Tiered | Up to 5% Back | 90+ |

Binance | Binance | Low | Up to 8% Back | 15+ |

BitPay | BitPay | Low | None | 10+ |

Tip: Always check the latest fee schedule before you order your malaysia crypto card. Some cards offer special deals or limited-time promos.

Supported Cryptocurrencies

You want a malaysia crypto card that supports your favorite coins. Here’s what you can expect:

UUPAY: Bitcoin, Ethereum, USDT, and more

Oobit: Bitcoin, Ethereum, USDT, BNB, XRP

Bybit: Bitcoin, Ethereum, USDT, and more top coins

RedotPay: Bitcoin, Ethereum, USDT, and others

Nexo: Bitcoin, Ethereum, USDT, and 40+ coins

Crypto.com: Bitcoin, Ethereum, USDT, and 90+ coins

Binance: Bitcoin, Ethereum, BNB, and more

BitPay: Bitcoin, Ethereum, USDT, and others

With so many choices, you can find the best crypto debit cards that fit your needs. Each malaysia crypto card offers different perks, so take your time and pick the one that matches your spending style.

UUPAY Crypto Debit Card Review

Features & Benefits

If you want a crypto debit card that’s easy to use and packed with perks, UUPAY might be your best pick. Right now, you can enjoy no card opening fee and no top-up fee during the promotional period. That means you get started without paying extra, which is perfect if you want to test the waters.

UUPAY supports over 10 popular cryptocurrencies, including Bitcoin, Ethereum, and USDT. You can spend your crypto anywhere that accepts major cards. The app makes it simple to manage your balance, track spending, and switch between coins.

Note: UUPAY stands out for its strong compliance. The company holds a US MSB license, registers in Hong Kong (meeting Asian regulatory requirements), owns a Swiss-licensed subsidiary, and has a Brazil license application in progress. You get peace of mind knowing your card comes from a trusted provider.

Pros & Cons

Here’s a quick look at what you’ll love—and what you might want to consider:

Pros:

🚀 No card opening or top-up fees during promo

👍 Supports 10+ major cryptocurrencies

🛡️ Strong compliance and global licenses

💳 Easy to use for everyday spending

Cons:

🌏 Limited to certain countries for now

💰 Fewer rewards compared to some competitors

📱 App features may feel basic if you want advanced tools

If you want a malaysia crypto card that’s simple, secure, and ready to use, UUPAY gives you a solid start.

Oobit Crypto Debit Card Review

Features & Benefits

Oobit gives you a simple way to spend your crypto in Malaysia. You can use the Oobit crypto debit card at stores, online shops, and even for ATM withdrawals. The card supports popular coins like Bitcoin, Ethereum, USDT, BNB, and XRP. You get instant conversion from crypto to local currency, so you never have to worry about exchange hassles.

You can manage your card through the Oobit app. The app lets you check your balance, track your spending, and switch between supported coins. Oobit offers low fees, which means you keep more of your money. You also earn cashback on every purchase. The card works with major payment networks, so you can use it almost anywhere.

Tip: If you want a card that’s easy to set up and use, Oobit makes the process quick. You can order your card online and start spending once it arrives.

Pros & Cons

Here’s what you’ll like about the Oobit crypto debit card:

Pros:

👍 Supports top cryptocurrencies

💸 Low fees for transactions

💰 Cashback rewards on purchases

📱 Easy-to-use mobile app

Cons:

🌍 Limited coin selection compared to some competitors

🏦 ATM withdrawals may have extra fees

🔒 Card availability may depend on your location

Oobit gives you a solid choice if you want a malaysia crypto card that’s simple and rewarding. You get flexibility and control over your crypto spending.

Bybit Crypto Card Overview

Cashback & Rewards

You want to get the most out of your crypto spending, right? The Bybit crypto card gives you a chance to earn real value every time you use it. With this card, you can enjoy up to 10% crypto cashback on your purchases. That means you get a portion of your spending back in crypto, which can add up fast if you use your card often.

Bybit makes it easy to track your rewards. You can check your crypto cashback balance in the app and see how much you have earned. The more you spend, the more you get back. Some categories or special promotions may offer even higher rates, so keep an eye out for those. If you like earning rewards while you shop, this card gives you a simple way to grow your crypto.

Security & Usability

You want your money to stay safe and your card to work everywhere. Bybit covers both. The card uses strong security features like EMV 3-D Secure, two-factor authentication, and real-time fraud monitoring. If you ever lose your card, you can freeze it instantly in the app.

Here’s a quick look at what you get:

Feature | Description |

|---|---|

Strong security | EMV 3‑D Secure, 2FA, fraud monitoring, card freeze |

Global acceptance | |

Payment support | Apple Pay and Google Pay compatible |

You can use your Bybit card at millions of places worldwide. It works with Apple Pay and Google Pay, so you can tap and go. You get peace of mind and flexibility, all in one card.

RedotPay Crypto Card Review

Payment Flexibility

You want a crypto card that fits your lifestyle, right? RedotPay gives you plenty of options. You can spend USDT directly, so you don’t need to convert your crypto before making a purchase. That saves you time and keeps things simple. If you’re just starting out, you’ll love the very low minimum top-up requirement. You don’t need a big deposit to get going.

Once you sign up, you get a virtual card that works instantly for online shopping. You can use it on platforms like AliExpress, Lazada, Netflix, and Grab. That means you can pay for your favorite services without waiting for a physical card. The fee structure is easy to understand, so you won’t get surprised by hidden charges.

Here’s a quick look at what RedotPay offers:

Feature | Description |

|---|---|

Spend USDT directly | No need to convert to other coins |

Low minimum top-up | Start with a small deposit |

Instant virtual card | Use online right away |

Simple fees | No hidden costs |

Works with top platforms | Compatible with AliExpress, Lazada, Netflix, Grab |

Fees & Global Use

You want to know what you’re paying for. RedotPay keeps things clear with a simple fee structure. You won’t find any sneaky charges or confusing terms. Most transactions come with low fees, so you keep more of your money.

RedotPay works almost anywhere in the world. You can use your card for online shopping, travel, or everyday spending. The virtual card lets you pay instantly, and you can order a physical card if you need it for in-person purchases. If you travel or shop internationally, RedotPay gives you the flexibility to spend your crypto wherever you go.

Tip: Always check the latest fee details before you top up your card. That way, you know exactly what to expect.

Nexo Crypto Debit Card

Dual-Mode Functionality

Nexo gives you something unique with its crypto debit card. You can choose how you want to spend. Want to use your crypto directly? Go for it. Prefer to keep your crypto and spend using your credit line? Nexo lets you do that, too. This dual-mode feature means you get more control over your money.

Here’s how it works:

Direct Spend: Use your Bitcoin, Ethereum, or other supported coins to pay for things right away.

Credit Line: Keep your crypto as collateral and spend from a credit line. Your assets stay in your account, and you only pay interest on what you use.

Tip: If you want to keep your crypto for the long term but still need to make purchases, the credit line mode is a smart choice.

User Experience

You’ll find the Nexo card easy to use, whether you’re shopping online or in stores. The app lets you switch between spending modes with just a tap. You can track your transactions, check your rewards, and freeze your card instantly if needed.

What you’ll like about the Nexo card:

No annual fees

Up to 2% cashback in crypto

Works with Apple Pay and Google Pay

Supports 40+ cryptocurrencies

The Nexo card gives you flexibility and peace of mind. You can manage everything from your phone, and you always know where your money goes. If you want a malaysia crypto card that puts you in control, Nexo is worth a look.

Crypto.com Visa Card Malaysia

Rewards & Perks

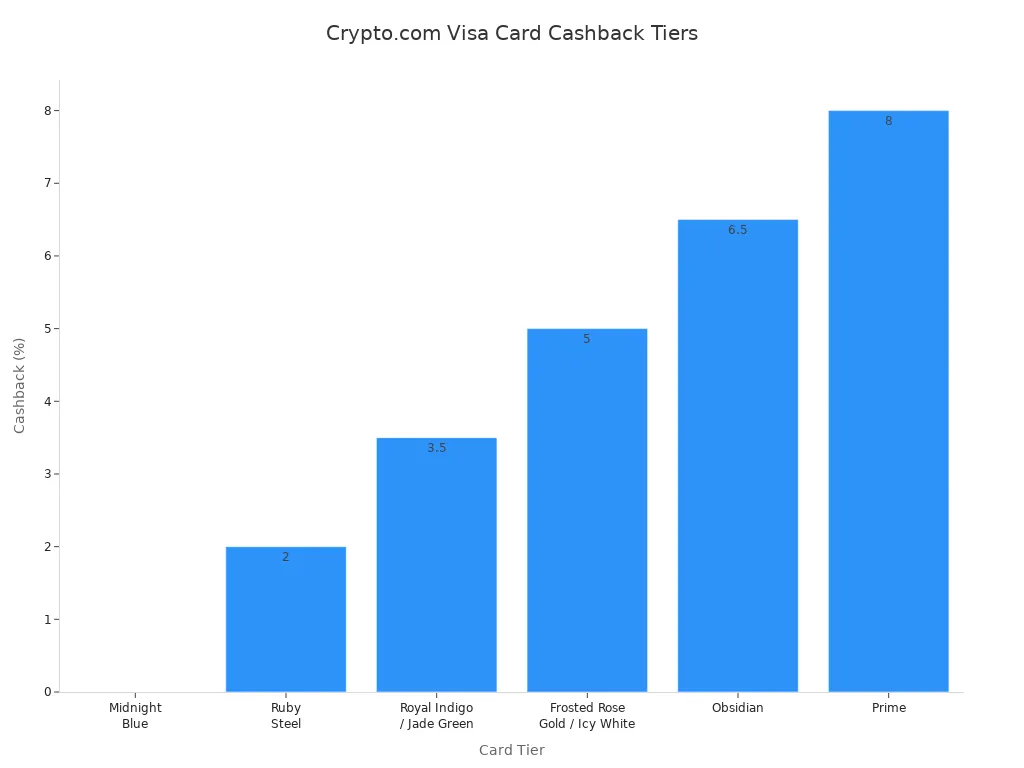

If you want a malaysia crypto card that packs a punch, the Crypto.com Visa Card stands out. You can unlock a bunch of rewards just by using your card for daily spending. The cashback rate goes as high as 8% if you stake enough CRO tokens. Even at lower tiers, you still get solid perks.

Here’s what you can look forward to:

Up to 8% cashback on every purchase (based on your CRO staking level)

Free Spotify and Netflix subscriptions for certain card tiers

Airport lounge access if you go for higher-tier cards

No annual fees or interest charges

You can see how the perks stack up across different tiers:

Tier | Stake Requirement | Cashback | Perks |

|---|---|---|---|

Midnight Blue | $0 | 0% | Basic features only |

Ruby Steel | $500 | 2% | Free Spotify (conditions apply) |

Royal Indigo / Jade Green | $5,000 | 3.5% | Spotify + Netflix, LoungeKey™ Access |

Frosted Rose Gold / Icy White | $50,000 | 5% | Extra perks, higher spending limits |

Obsidian | $500,000 | 6.5% | Concierge, top-tier benefits |

Prime | $1,000,000 | 8% | Private support, all top perks |

Tip: You don’t pay any annual fees, so you can focus on earning rewards without worrying about extra costs.

Supported Cryptos

You want flexibility when spending your crypto. The Crypto.com Visa Card delivers. You can use over 90 different cryptocurrencies, including Bitcoin, Ethereum, USDT, and many more. This wide support means you can always pay with your favorite coins, whether you’re shopping online or grabbing a coffee in town. If you want one of the best crypto debit cards in Malaysia, Crypto.com gives you both choice and convenience.

Binance Visa Card Malaysia

Spending & Conversion

With the Binance Visa Card, you can spend your crypto just like cash. You do not need to convert your coins to ringgit before shopping. The card links directly to your Binance account. You can top up with Bitcoin, BNB, or other supported coins. When you make a purchase, Binance handles the conversion instantly. This means you pay with crypto at checkout, and the merchant receives local currency.

You can use your Binance Visa Card at millions of places around the world. It works anywhere that accepts Visa. You can shop online, pay at restaurants, or even withdraw cash from ATMs. The process feels just like using a regular debit card. You do not have to worry about complicated steps or hidden conversions. Everything happens automatically in the background.

Tip: Keep an eye on your crypto balance in your Binance app. You can choose which coin to spend first, giving you more control over your money.

Fees & Limits

You want to know what you are paying for. The Binance Visa Card keeps fees low for Malaysians. There are no annual fees or monthly charges. Most transactions come with zero fees, but some ATM withdrawals or foreign currency payments may have small costs. Always check the latest fee schedule in your Binance account.

Here is a quick look at common fees and limits:

Feature | Details |

|---|---|

Annual Fee | None |

Transaction Fee | 0% (in most cases) |

ATM Withdrawal Fee | Small fee may apply |

Daily Spending Limit | Up to 8,700 MYR (approx.) |

You get high spending limits and simple fees. The Binance Visa Card makes it easy to use your crypto every day in Malaysia.

BitPay Bitcoin Debit Card

Bitcoin Spending

You want a simple way to use your crypto for everyday purchases. BitPay makes it easy with one of the most popular bitcoin debit cards. You can load your card with Bitcoin and spend it anywhere that accepts Mastercard. You don’t need to worry about complicated steps. Just swipe, tap, or use your card online. The card converts your Bitcoin to local currency at the time of purchase. You get instant access to your funds. Many people choose bitcoin debit cards because they want to avoid waiting for bank transfers. You can pay for groceries, shop online, or grab a meal at your favorite restaurant. BitPay gives you flexibility and speed. You can even withdraw cash from ATMs using bitcoin debit cards. The process feels just like using a regular debit card. You don’t need to be a tech expert to use bitcoin debit cards. The BitPay app helps you manage your balance and track your spending. If you want to make the most of your crypto, bitcoin debit cards offer a practical solution.

Security Features

Security matters when you use bitcoin debit cards. BitPay protects your money with advanced security tools. You get EMV chip technology, which helps prevent fraud. The app lets you freeze your card if you lose it. You can set spending limits and get instant alerts for every transaction. Many users like bitcoin debit cards because they offer strong privacy. BitPay does not share your personal data with merchants. You control your account from your phone. If you want peace of mind, bitcoin debit cards from BitPay give you that. You can shop, travel, and spend with confidence. The security features make bitcoin debit cards a smart choice for anyone in Malaysia.

How to Choose the Best Crypto Debit Card in Malaysia

Key Factors for Malaysians

You want to find the best crypto debit cards that fit your lifestyle. Start by thinking about how you plan to use your card. Do you shop online, travel, or just want to spend crypto at local stores? Each card offers something different. Some cards work better for daily spending, while others shine for travel or online shopping.

Look at the coins each card supports. The best crypto debit cards let you use your favorite cryptocurrencies. If you hold Bitcoin, Ethereum, or stablecoins, make sure your card supports them. You also want a card that is easy to manage. A good mobile app helps you track spending, freeze your card, and switch between coins.

Tip: Always check if the card is available in malaysia before you apply.

Comparing Fees & Rewards

Fees and rewards can make a big difference. The best crypto debit cards keep fees low and offer strong rewards. Watch out for hidden costs like ATM withdrawal fees, foreign transaction fees, or monthly charges. Some cards have no annual fee, while others might charge for certain services.

Here’s a quick checklist to help you compare:

What is the cashback rate?

Are there any annual or monthly fees?

Does the card offer extra perks like free subscriptions or airport lounge access?

How easy is it to earn and redeem rewards?

The best crypto debit cards give you value every time you spend. Take your time, compare your options, and pick the card that matches your needs.

Bitcoin Debit Cards Explained

How They Work in Malaysia

You might wonder how a bitcoin debit card actually works in Malaysia. It’s pretty simple. A crypto debit card lets you spend your bitcoin or other cryptocurrencies just like you would with a regular bank card. You link your crypto debit card to your wallet, and when you make a purchase, the card converts your bitcoin into Malaysian ringgit on the spot. You can use your crypto debit card at any store or online shop that accepts Visa or Mastercard.

Here’s what you get with a crypto debit card in Malaysia:

You can spend bitcoin at millions of places worldwide.

The crypto debit card gives you the freedom to convert bitcoin to cash or keep it as an investment.

You can use your crypto debit card as a backup in emergencies, since it often has fewer restrictions than a normal bank card.

Getting a crypto debit card is easy. You just need a small amount of bitcoin to apply.

A crypto debit card makes it easy to use your digital assets for daily life. You don’t have to worry about complicated steps. Just swipe, tap, or shop online with your crypto debit card.

Regulations & Tips

You need to know the rules before you start using a crypto debit card in Malaysia. The country does not treat bitcoin as legal tender, but you can still use a crypto debit card for spending. Most crypto debit card providers follow strict KYC (Know Your Customer) and AML (Anti-Money Laundering) rules. You will need to verify your identity when you sign up for a crypto debit card.

Tip: Always check if your crypto debit card provider supports Malaysia. Some cards may not ship to every country.

Keep these tips in mind when using a crypto debit card:

Watch out for fees. Some crypto debit card companies charge for ATM withdrawals or foreign transactions.

Track your spending in the app. A good crypto debit card app helps you manage your money.

Stay updated on local regulations. Rules about crypto debit card use can change, so check for updates from Bank Negara Malaysia.

A crypto debit card gives you a new way to spend and manage your crypto. If you want flexibility, convenience, and global access, a crypto debit card is a smart choice in Malaysia.

You have plenty of great crypto card options in malaysia. UUPAY, Oobit, and Crypto.com stand out for rewards and flexibility. Before you choose, think about what matters most:

Instant virtual cards make shopping easy.

Strong security keeps your funds safe.

Wide acceptance lets you spend anywhere.

Explore each provider’s site for the latest updates.

FAQ

What are the main benefits of using crypto cards in Malaysia?

You can spend crypto like cash, earn rewards, and enjoy global acceptance. Many cards offer instant conversion and support for top coins.

How do I choose the right cards for my needs?

Check which cards support your favorite coins. Compare fees, rewards, and app features. Pick cards that fit your lifestyle and spending habits.

Can I use multiple cards from different providers?

Yes, you can hold several cards at once. Many users mix cards for different perks. Just make sure each bitcoin debit card provider supports Malaysia.

See Also

How Malaysians Can Use Crypto Debit Cards on Shopee

Top Crypto Visa Prepaid Cards Available for Malaysians

Comprehensive Guide to Web3 Payment Cards for Southeast Asia