Top Digital Payment Platforms for Bitcoin Visa Cards

You have more choices now for digital payment platforms for your bitcoin visa card or crypto debit cards. Some of the best options are:

UUPAY

BVNK

BitPay

Wirex

Coinbase

Gemini

RedotPay

CoinGate

OpenNode

Bitrefill

MoonPay

People use these payment platforms for daily spending. They make payments fast and easy. You should check things like cashback rewards, payment fees, strong security, and global payment access to pick the best one for you.

Key Takeaways

Check out different digital payment platforms for bitcoin visa cards, like UUPAY, BitPay, and Wirex. This helps you pick the one that works best for you.

Try to find cashback rewards and low fees when you choose a crypto debit card. This will help you save more money and get more benefits.

Make sure the card has strong security features, such as two-factor authentication. This keeps your money safe when you use crypto payment gateways.

Think about how easy the card is to use and if you can use it in many countries. This is important if you travel or pay people in other countries.

Always look for special deals, like UUPAY’s offer of no card or recharge fees. This can help you spend less money when using crypto.

Bitcoin Visa Card Basics

How Bitcoin Visa Cards Work

You might wonder how a bitcoin visa card actually works. When you use one, you spend your crypto just like you would with regular money. You load your card with bitcoin or other cryptocurrencies. When you make a payment at a store or online, the card converts your crypto into local currency instantly. You don’t need to worry about finding a place that accepts crypto. The card handles everything for you. You can use crypto debit cards for groceries, travel, or even online shopping. Some cards offer cashback rewards every time you make a payment. You get a percentage of your spending back, which can add up quickly. You can also track your payments and manage your balance through an app. This makes it easy to stay on top of your spending.

Tip: Always check your card’s app for the latest cashback offers and payment history. This helps you maximize your rewards and keep your finances organized.

Benefits of Bitcoin Visa Cards

You get many benefits when you use a bitcoin visa card instead of a traditional debit card. Let’s look at some of the biggest advantages:

Benefit | Bitcoin Visa Cards | Traditional Debit Cards |

|---|---|---|

Yes | No | |

Full control over assets | Yes | Limited control |

Global access to funds | Yes | May require off-ramps |

Smoother transitions between fiat and crypto | Yes | Often cumbersome |

You can spend your crypto right away without waiting for conversions. You have full control over your assets, which means you decide how and when to use your money. You get global access, so you can make a payment almost anywhere. Switching between crypto and regular money feels smooth and easy. Many crypto debit cards also give you cashback rewards, so you earn cashback every time you pay. You don’t just get convenience; you also get extra value. Security is another big benefit. Most cards use strong protection to keep your money safe. You can enjoy peace of mind while you shop, travel, or pay bills.

Best Crypto Debit Cards Platforms

UUPAY Overview

UUPAY is good if you want to spend crypto every day. Signing up and making your first payment is easy. UUPAY has a special year-end deal right now. You do not pay for the card or any recharge fees during this time. You can start using your card without extra costs.

Key features:

You get your card for free and pay no recharge fees for a short time.

Your crypto turns into regular money right when you pay.

You earn cashback every time you buy something.

You can pay with stablecoin or bitcoin visa card.

The app helps you see your spending and rewards.

Pros:

Fees are low, especially with the promotion.

Payments with crypto are fast.

Your money is kept safe.

You can connect the card to your wallet easily.

Cons:

The special offer will end soon.

The card might not work in every country.

Best for: You want more cashback and fewer fees. UUPAY is also good if you are new to crypto debit cards.

Tip: Get your free card before the deal ends!

BVNK for International Payments

BVNK helps you make payments in other countries with your crypto debit card. The platform works in over 130 places and can handle lots of payments. BVNK lets you use both regular money and stablecoin to send money anywhere.

BVNK offers:

Payments settle fast all over the world.

It follows rules in many countries.

You can have accounts in USD, EUR, and GBP.

You can pay in and out with crypto on many blockchains.

Checkout is easy in different languages.

You benefit from:

Moving money between regular and stablecoin is simple.

Crypto payments are quick and work well.

BVNK handles over $25 billion in payments each year.

It has more than 25 licenses for global use.

Pros:

Good for spending money in other countries.

Lets you use stablecoin easily.

Payments are fast and work well.

Cons:

It may be hard for beginners.

Some tools are best for businesses.

Best for: You travel or send money to other countries. BVNK is great if you want stablecoin payments and strong rules.

BitPay Features

BitPay lets you spend crypto anywhere Visa is accepted. You can use the card for shopping, travel, or online. BitPay changes your crypto to regular money right away, so you do not need a special store.

Key features:

Crypto turns into regular money instantly.

You get cashback every time you pay.

There are no yearly fees.

You can pay with stablecoin or bitcoin.

You can use Apple Pay and Google Pay.

Pros:

Transaction fees are low.

The app is easy to use.

Security is strong.

Cons:

Only works in some countries.

Some rewards have limits.

Best for: You want a card for daily spending and cashback. BitPay is also good if you want to use mobile wallets.

Wirex Cashback Rewards

Wirex is known for giving lots of cashback. You can get up to 8% back in crypto when you pay. The card lets you use bitcoin and stablecoin, so it works for many people.

Key features:

You can earn up to 8% cashback.

You can use many types of money, including stablecoins.

No yearly fees.

Crypto turns into regular money right away.

The app helps you track rewards.

Pros:

Cashback rates are high.

Most transactions have low fees.

Beginners find it easy to use.

Cons:

Your cashback depends on your account type.

Some countries cannot use Wirex.

Best for: You want to earn crypto and love cashback. Wirex is also good if you want to spend crypto in different currencies.

Coinbase One Card

The Coinbase One Card lets you spend crypto and earn rewards. The card works almost everywhere. Coinbase is safe and connects easily to your Coinbase wallet.

Key features:

You earn crypto rewards every time you buy something.

Crypto turns into regular money instantly.

No yearly fees.

You can pay with stablecoin.

The app is easy to use.

Pros:

Coinbase is trusted and keeps your money safe.

Most users pay low fees.

Managing your card and rewards is simple.

Cons:

Only for Coinbase users.

Some tools need a subscription.

Best for: You use Coinbase and want to earn crypto rewards when you spend.

Gemini Credit Card

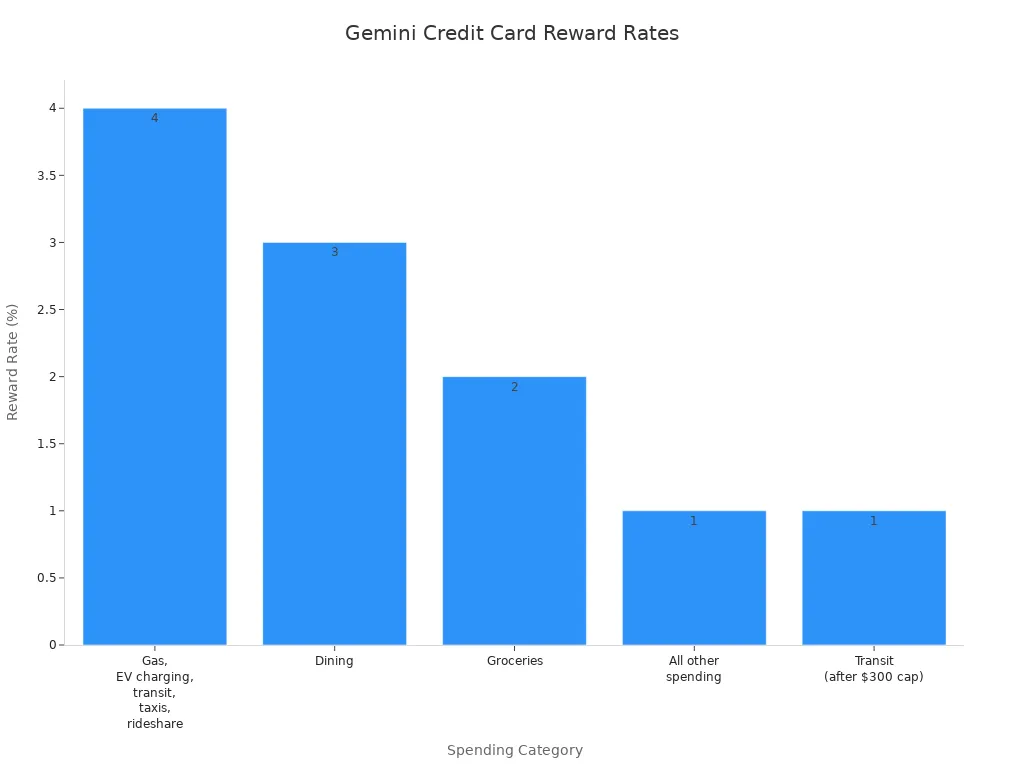

The Gemini Credit Card lets you earn crypto rewards in different ways. You get different cashback rates for different things you buy. Rewards come fast and work at many stores.

Spending Category | Reward Rate | Monthly Cap |

|---|---|---|

Gas, EV charging, transit, taxis, rideshare | 4% back | Up to $300 |

Dining | 3% back | N/A |

Groceries | 2% back | N/A |

All other spending | 1% back | N/A |

Transit (after $300 cap) | 1% back | N/A |

Pros:

You get more cashback for gas and travel.

No yearly fees.

Crypto rewards come right away.

Cons:

The highest rewards have a monthly limit.

Only works in some places.

Best for: You want more cashback for travel and food. Gemini is good if you want a crypto credit card with different rewards.

RedotPay Global Payments

RedotPay makes it easy to pay anywhere in the world. You can spend crypto wherever Visa is accepted. The platform changes your crypto to regular money right away.

Advantages | Disadvantages |

|---|---|

N/A | |

Global Spending | N/A |

Easy Setup | N/A |

Pros:

Setting up is quick and easy.

You can spend crypto worldwide.

You do not need to worry about exchange rates.

Cons:

Not much info about fees.

Best for: You want to spend crypto everywhere with no trouble. RedotPay is good if you want a card that works fast.

CoinGate Payment Gateway

CoinGate is great for people and businesses who want flexible crypto payments. You can pay with more than 50 cryptocurrencies, like bitcoin and stablecoin. CoinGate charges a 1% fee for most payments.

You can use 50+ cryptocurrencies.

Most coins have a 1% transaction fee.

You can pay with 15+ popular coins like Bitcoin, USDC, Ethereum, and Litecoin.

Big businesses pay lower fees.

It is easy to connect to online stores.

Pros:

Payment fees are low.

Many coins are supported.

Good for online businesses.

Cons:

Does not give you a physical card.

Some tools need technical setup.

Best for: You run a business or want a flexible way to pay with stablecoin and crypto debit cards.

OpenNode for Merchants

OpenNode helps businesses get fast and safe crypto payments. You can accept bitcoin and stablecoin with low fees. The platform is easy to connect to your website or store.

Key features:

You get paid instantly in regular money or crypto.

All payments have low fees.

Your money is kept safe.

It is easy to add to online shops.

Pros:

Payments are fast for businesses.

You can choose how you get paid.

Support is reliable.

Cons:

No physical card for shoppers.

Some tools are best for businesses.

Best for: You own a business and want to take crypto payments with low fees and strong safety.

Bitrefill Gift Cards

Bitrefill lets you use crypto to buy gift cards for many brands. You can pay with bitcoin, stablecoin, or other coins. This is a good way to use crypto for daily shopping.

Key features:

Many gift cards to choose from.

You get your gift card right after you pay.

You can pay with stablecoin or bitcoin.

No yearly fees.

Anyone can use it easily.

Pros:

Spend crypto at your favorite stores.

You do not need a physical card.

Checkout is fast and simple.

Cons:

No cashback rewards.

Only for buying gift cards.

Best for: You want to use crypto for shopping, travel, or fun without a card.

MoonPay Crypto Purchases

MoonPay helps you buy crypto with your card and spend it fast. The app is simple and works with many coins and stablecoins. MoonPay makes payments quick and connects easily to wallets.

Key features:

Buy and spend crypto right away.

You can pay with stablecoin or bitcoin.

Payments are processed quickly.

Easy to connect to wallets and apps.

No yearly fees.

Pros:

Good for starting with crypto debit cards.

Most transactions have low fees.

The app is easy to use.

Cons:

Not a regular debit card.

Some places may have limits.

Best for: You want to buy and spend crypto quickly. MoonPay is good if you want to use your favorite apps.

Note: Each platform has special benefits. Compare features, cashback, and fees to pick the best crypto debit card for you.

Cryptocurrency Payment Gateways Comparison

Security and Privacy

You want your money to be safe. Most cryptocurrency payment gateways use strong security. They protect your money with special tools. Platforms like UUPAY, BitPay, and Coinbase keep your funds safe. These gateways use two-factor authentication. They also use encryption to hide your payment details. Your information stays private. You can trust these platforms for crypto payments. Security is very important when you use crypto debit cards or a bitcoin visa card.

Fees and Limits

You want to pay less in fees. Many gateways, like Wirex and BitPay, have low fees. Some, like UUPAY, offer special deals. UUPAY gives free card setup right now. You do not pay recharge fees during their year-end event. You can earn cashback rewards every time you pay. Most platforms let you use stablecoin payment gateways. This helps you save more money. You get auto-conversion to fiat, so you do not worry about exchange rates. Some cards have spending limits. You can check these limits in the app.

Supported Countries

You want to use your card everywhere. Most gateways work in many countries. They support instant global settlement and easy fiat integration. BitPay, RedotPay, and BVNK work in lots of places. You can pay with stablecoin or crypto debit cards almost anywhere. Some platforms, like CoinGate and OpenNode, help businesses with stablecoin payment gateways. Always check if your country is supported before you sign up.

User Experience

You want an easy app and quick rewards. Most gateways give you cashback and crypto rewards after you pay. The apps help you track spending and rewards. You can earn cryptocurrency rewards and connect your wallet easily. Many platforms, like Gemini and Wirex, offer different cashback for each payment type. You get the benefits of crypto debit cards, stablecoin, and fiat all in one place.

Tip: Look at the table below to find the gateway that fits you best.

Platform | Fees | Supported Regions | Cashback Rewards | Stablecoin Support | Integration Type |

|---|---|---|---|---|---|

UUPAY | Low/Promo | Global | Yes | Yes | Seamless fiat integration |

BitPay | Low | US/EU | Yes | Yes | Auto-conversion to fiat |

Wirex | Low | EU/Asia | Up to 8% | Yes | Instant global settlement |

Coinbase | Low | US/EU | Yes | Yes | Wallet integration |

Gemini | Low | US | Up to 4% | Yes | Crypto rewards |

BVNK | Low | 130+ countries | No | Yes | Stablecoin payment gateways |

RedotPay | N/A | Global | No | Yes | Seamless fiat integration |

CoinGate | 1% | Global | No | Yes | Stablecoin payment gateways |

OpenNode | Low | Global | No | Yes | Crypto payment processing |

Bitrefill | None | Global | No | Yes | Gift card integration |

MoonPay | Low | Global | No | Yes | Wallet integration |

You can see what each gateway offers. Look for low fees, cashback, and stablecoin support. Pick the one that matches how you want to pay.

Choosing the Best Crypto Debit Card

Assessing Your Needs

You want a card that fits your lifestyle. Start by thinking about how you spend money. Do you shop online, travel, or pay bills with crypto debit cards? If you want to earn rewards in bitcoin or stablecoin, look for cards with high cashback rewards. Some cards focus on daily spending, while others work better for travel. If you need global access, pick a card that supports payment in many countries. You should also check if you want to use stablecoin payment gateways for smoother transactions.

Tip: Make a list of your top priorities. This helps you find the best cards for earning crypto and getting the most benefits.

Factors to Consider

When you choose a bitcoin visa card, you need to look at more than just the brand. Here are some things to check:

Cashback: Some cards offer high rewards for every payment. Others give lower rates but have extra perks.

Fees: Look for low fees. Some platforms, like UUPAY, even have special deals with no card or recharge fees during their year-end event.

Security: Pick a gateway with strong protection for your money.

Integration: Make sure the card works well with your wallet or app.

Stablecoin: If you use stablecoin often, choose a card with easy integration and support.

Taxes: Remember, you may need to report crypto rewards or cashback to the IRS.

Platform Recommendations

If you want high rewards and cashback, try Wirex or Gemini. These cards help you earn rewards in bitcoin and stablecoin. For low fees and easy integration, UUPAY stands out, especially with its current promotion. BitPay and Coinbase offer strong security and simple payment options. If you run a business, CoinGate and OpenNode have great stablecoin payment gateways. RedotPay and BVNK work well for global spending. Always check the benefits, crypto rewards, and how each card handles payment and integration. Pick the card that matches your needs and helps you get the most out of your crypto debit cards.

You have many choices for a bitcoin visa card. UUPAY stands out with its year-end deal—no card fee and no recharge fee during the event. You can enjoy cashback rewards on every payment. If you want more cashback, check Wirex or Gemini. Before you pick, look at the payment comparison table and see which platform fits your needs. Think about payment security, payment integration, and global payment access. You can earn cashback and crypto rewards with the right card. Start your payment journey today and get the most cashback possible.

FAQ

How do bitcoin visa cards handle payment in stores?

You use your card just like any regular debit card. The card converts your crypto into local money at checkout. You can make payment at most places that accept Visa.

What is a cryptocurrency payment gateway?

A cryptocurrency payment gateway lets you pay with bitcoin or stablecoin. It helps you send money to stores or friends. You get fast payment and strong security.

Can I earn rewards with my crypto debit card?

Yes, many cards give you cashback on every payment. Some platforms, like Wirex and Gemini, offer higher rewards. UUPAY now has a year-end deal with no card fee and no recharge fee.

Is it safe to use a crypto payment gateway?

You get strong protection with most gateways. They use security tools like two-factor authentication. Your payment details stay private. Always check the safety features before you sign up.

Which crypto debit card works best for global payment?

You want a card that supports payment in many countries. BVNK and RedotPay work well for global payment. UUPAY also offers easy payment and low fees during its promotion.

See Also

Top Bitcoin Cards For Daily Purchases And Expenses

Using Bitcoin Debit Cards For Instant Crypto Transactions

Advantages Of Crypto Cards For Marketplace Fees In Southeast Asia

Visa Prepaid Card Alternatives For Malaysian Crypto Users

Comprehensive Guide To USDT Visa Cards For Unbanked Spending